With the benefit of hindsight, few tasks look easier than pointing out a market peak. Looking at a price chart of the stocks market, it is easy to point to the top and say, “Here is where to sell stocks.” Unfortunately, there are few indicators that help anticipate market tops. While market valuation is useful over 10-year periods, it is a poor indicator over a 1-year period. At Crestwood, we believe that trying to beat the market by attempting to anticipate the stock market’s ups and downs is a fool’s errand due to the sporadic nature of returns, importance of tax-deferred compounding and irrational behavior of investors.

Every day matters

Over the past seven calendar years, if you missed the best 5 days in the stock market your return drops significantly, falling from 132.7% to 87.6%! The below chart shows the outsized effect of missing days in the market can have on long-term returns:

Making matters more difficult, the worst and best days are often clustered together during periods of high volatility. Given the speed at which stock prices adjust to news, a successful market timer needs to anticipate the news, especially the unexpected.

A good example of these market timing difficulties occurred in May of 2010 when concerns over European and Greek debt had stock markets falling. On Thursday, May 6th around 2:30, a single high frequency trader hit the market with a flood of orders which drove stocks down 9% in a few minutes. The Dow Jones Industrial Average dropped 998.5 points, its largest ever intraday drop up to that point. This sudden jolt became known as the “flash crash.” That afternoon, stocks partially recovered to finish down 3.2% for the day.

After a calmer Friday, stocks rebounded 4.4% the following Monday morning as European officials approved a nearly $1 trillion rescue package to contain the debt crisis. A market timer who may have sold Thursday after the flash crash would have needed to anticipate the announcement and buy back on Friday in the absence of any new news to partake in the 4.4% recovery. Buying stocks on Monday, after the announcement was too late. An investor who sold after the flash crash bore the 3.2% decline and missed the 4.0% rebound. The below chart depicts how quickly the markets reacted both to the downside and the upside in just a few minutes over the three day period.

Taxes matter

Second, for taxable investors, to buy and sell the stock market, you will realize gains, pay taxes and forego the benefit of tax-deferred compounding. Taxes are boring and often ignored, but they do matter significantly over the long run. Over the past seven calendar years, the S&P 500 index has returned 132.7%, a good time to be invested! If you sold stocks and realized gains each month, the seven-year return drops over 40% to 72.9% (assuming short-term gain taxes at 50%). Additionally, as capital is reduced to pay taxes, you’ll have less assets available to be invested. The benefit of compounding returns is powerful over time. Investors who time the markets need to perform much better than the market to account for the higher taxes and loss of compounding.

Human behavior matters

In the following we outline just a few of the pitfalls of human behavior which can impair an investor’s decision making and ability to make sound investment decisions, particularly in the short term.

1. Innately Irrational: Much of economic and efficient market theory is based on a foundation that humans behave rationally seeking to maximize wellbeing without regards to emotions. However, the study of Behavioral Economics finds areas where humans consistently make irrational decisions. We believe the markets are fundamentally unpredictable due to human irrationality.

The famous English economist John Maynard Keynes once quoted: “The stock market was mostly a beauty contest in which judges picked who they thought other judges would pick, rather than who they considered to be the most beautiful”. Michael Lewis’ excellent book “The Undoing Project” describes many of these behavioral pitfalls and the people behind this research.

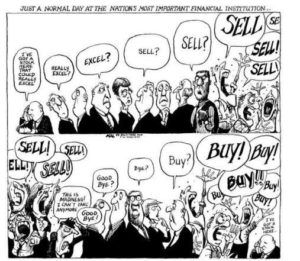

2. Groupthink:

Groupthink explains that most people would rather be wrong like everyone else than be wrong by oneself. What if you take out your trash and see that your trash can is the only one on the street? Certainly, you would check your calendar, watch or schedule to confirm that you are not mistaken. With investing people are less willing to take a risk that, in hindsight, could look foolish, lose money or get you fired.

Groupthink is a strong explanatory factor for the existence of bubbles and manias. Most people realized the dot-com bubble was irrational, but year after year during the run-up in prices investors in these stocks made heaps of money. Those who did not participate, underperformed the market by a wide margin. Overconfidence was rife as people quit their jobs to become day traders. Valuations were insane like in Holland in the 1600s when one could buy a house for three tulips. For much of the late 1990s, sound investing massively underperformed and reckless speculation was rewarded. Not only were individuals herding, but many advisors and institutional investors joined as well, fearing underperforming the market. The internet was going to change the world and we had entered a new investor paradigm (sound like Bitcoin, perhaps?).

3. Overreaction to news: Unfortunately, humans do not always recall or evaluate news in a rational, even-handed way. Studies show investors tend to overreact to both positive and negative news on the day it is released, giving greater credit to news that is most recent, invokes emotions or confirms a bias. Sensationalized news like shark attacks, natural disasters and serial killers receives a disproportionate amount of attention. Investors are more likely to recall that insurance companies’ earnings fell in the quarter a hurricane occurred rather than the post-hurricane increases in underwriting premiums which could be a better indicator of future performance.

4. Fear of loss: Humans have a larger emotional response to losses than gains and typically display an asymmetrical perception of loss. For example, a $5 loss in a stock price since purchase price will likely evoke more of a response than a $5 gain. This tendency can lead to irrational behavior as was seen in “Black Monday”, the stock market crash of October 19, 1987, when stocks fell 22.6% in one day. In retrospect, the main cause of the crash was program trading that focuses on portfolio insurance. The idea of portfolio insurance in appealing – if a stock falls below a certain price, it is sold thus stopping the loss. However, taken collectively stop loss orders increase selling when the market is already falling. This forced selling makes a bad situation worse as investors put buy orders on hold and liquidity dries up. Today, exchanges have circuit breakers that halt trading for a certain time to allow investors to regain their sanity. Human’s fear of loss adds to market volatility and further reduces the ability to predict the markets rationally.

A strategy for long term success

Crestwood does not try to predict the near-term direction of stock prices even when valuations are extreme. As John Maynard Keynes said “The market can stay irrational longer than you can stay solvent.” Valuations are helpful to analyze potential long-term returns, but mean next to nothing in the short term. When setting allocation to stocks we focus on each client’s goals and constraints. Successful investors stick to their financial plan and are less reactive to daily market noise and human hyperbole.

Crestwood’s research efforts are aware of these investor behavioral pitfalls and we works hard to avoid them. Pride, arrogance and overconfidence are the root causes of many behavioral issues. Crestwood knows teamwork, objective analysis and humility are important ingredients to successful long-term investing. When analyzing companies or asset classes we gather as much information as possible and openly discuss the pros and cons as a group, valuing knowledge and shunning emotional attachment. Active debate, honest communication and a focus on obtaining the best results for clients helps us to make decisions that help clients achieve their long-term goals.