Attached is the Q4 Guide to the Markets from JP Morgan. Below I have pulled out two useful charts that point to the benefits of investing in and maintaining a diversified portfolio.

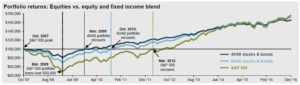

Portfolio Returns (S&P 500 vs. Stock/Bond Mix)

Even given the strong recovery of the stock market over the past decade, an investor with a diversified portfolio would have nearly exacted the returns of the S&P 500 while maintaining a lower risk profile.

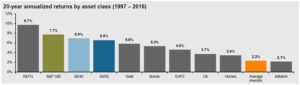

20 – Year Returns (Asset Class vs. Mix vs. Average Investor)

Here is another example of how the results of the average investor generally lag those of a stock/bond mix over time. The “average investor” is based on an analysis utilizing the net of aggregate mutual fund sales, redemptions and exchanges each month. The goal is to quantify investor behavior and indicate that sticking to one’s strategy is generally beneficial in the long run.