Fortive recorded its third consecutive quarter of double digit earnings growth as net earnings were up 16% yoy. The financial performance this quarter demonstrates the strength of Fortive’s market position, industry leading innovation, and the diversity of its product base. FTV also took steps to strategically position itself for enhanced long-term growth through M&A.

1.) FTV continues to record double digit earnings growth with strong performance across its broadly diversified platform.

a. Net earnings of $271.5 million were up 16% yoy, marking the third consecutive quarter of double digit earnings growth.

b. All six strategic platforms grew core sales and four of six grew core sales mid-single digits or better

c. High growth markets grew with double digit growth in Asia and Latin America. China growth was in the mid-teens for the quarter.

d. FTV posted record gross margin of 49.8% and operating profit was 21.1% for the quarter

2.) FTV continues to make progress towards increasing growth and recurring revenue. Growth was seen across all six segments (broken down between two categories). FTV raised its 2017 EPS guidance range.

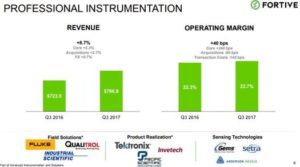

a. Professional Instrumentation – posted sales growth of 8.7% with core revenue growth of 5.3%

i. Two recent acquisitions in the space included ISC, a leading provider of portable gas detection equipment and Landauer, a subscription based radiation exposure service within the medical market. ISC is a strong independent business that should see positive synergies with the Fluke business.

b. Industrial Technologies – revenue grew 6.5% with core revenue growth of 4.4%

i. Transportation technologies posted low-single digit revenue growth reflecting solid sales growth across the platform

ii. Telematics grew in the mid-single digits helped by adoption of electric logging devices in small to medium business segment.

iii. Automation and specialty grew core sales high-single digits driven by continued double-digit growth in high growth markets and robotics.

c. FTV is raising 2017 full year net EPS guidance to $2.82 to $2.86

i. Includes core revenue growth expectation of mid-single digits

ii. Anticipate margin expansion of 50 bps for the year and free cash flow conversion of 105%

6 Total Segments Broken into Two Categories (positive growth across all segments)

FTV Thesis:

– Market leader:

• Leadership position in most of the markets they serve

• Experienced leadership team

• Above industry margins with strong cash flows

– Quality:

• FCF yield ~5%

• Organic growth target of 3-3.5% (4-5% in last 2 quarters after being under the target in prior quarters)

• M&A strategy to enhance top line growth

• Margins expansion from new products introduction, continued application of the Fortive Business Systems and M&A integration

– Shareholder friendly:

• Management team focused on shareholder wealth creation through top line sustainability and margin expansion