LISIX – Q4 2017 Commentary

The Lazard International Strategic Equity Fund outperformed the MSCI EAFE Index during the fourth quarter, and outpaced the benchmark by almost 300 bps for the year. The team continues to focus on stock selection, maintaining a long term outlook on companies with sustainable high or improving earnings growth.

Market Overview:

– International equities rose further in the fourth quarter of 2017

o Growth indicators remained broadly positive, especially in Europe

o Commodities including oil were on a firmer footing while a tax reduction plan was finalized in the United States

– Bond yields remain at historically low levels

o Money continued to flow into equities with a cyclical bias

– More cyclical sectors outperformed more defensive sectors

Performance Overview:

– LISIX outperformed the MSCI EAFE Index in the fourth quarter

– Outperformance was driven by encouraging results from a number of holdings:

o Fanuc and Bombadier in the industrials sector

o Informa, Cyberagent, and Don Quijote in the consumer discretionary sector

– Portfolio has benefited from its low level of exposure to stocks in telecom and utilities

– On the negative side, German industrial company Kion provided a disappointing update

o Additionally, Swedbank fell on rising concerns over Swedish housing market

o Portfolio suffered from lack of commodity exposure

Market Outlook:

– Data is broadly encouraging with sentiment indicators at highs in the US and Europe

o Buoyed by credit growth and the prospect of US tax cuts and French reform

– More benign commodity environment and some increased confidence is feeding into strong industrial demand

o Chinese consumers are spending again now driven by rising personal credit

– The portfolio team continues to identify a strong stream of interesting investment ideas

o Many market valuation metrics look stretched leaving overall market direction dependent on a benign combination of reasonable growth

– Team remains confident by focusing on stock selection they can generate alpha

o Focus on companies with sustainably high or improving returns

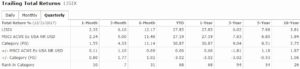

Performance Review: