BEXIX – Q4 2017 Commentary

The Baron Emerging Markets Fund underperformed its benchmark during the fourth quarter but substantially outperformed for 2017. The team has taken advantage of its unique forward looking, bottom-up approach and feels the portfolio is well positioned in the current market environment.

Market Overview:

– Emerging market equities led global markets throughout a strong year powered by healthy economic growth, strong earnings, and favorable policy support

o In addition, elections and political risks were resolved favorably during the latter months of the year

o Improvements in India, Brazil, Chile, Argentina, and South Africa helped fuel confidence and valuation support

– The team is intrigued by an explicit goal in China to gain market and profit share form Western multinationals in high value-add sectors

o Believe the portfolio could broadly benefit EM corporate earnings, particularly relative to major global companies that represent a significant presence in developed world

– Remain optimistic that their differentiated discipline and process position us well over the long term to take advantage of substantial investment opportunities

Performance Overview:

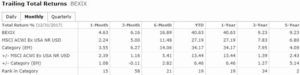

– During the fourth quarter BEXIX underperformed its index but substantially outperformed for the full year

– The strategy has outperformed both the EM Index and peer group since fund inception

– During Q4, the largest driver of adverse relative performance was stock selection

o Within tech, corrections in China based Bitauto and Sunny Optical drove down performance

o Within consumer discretionary, Smiles Fidelidad and TAL Education both corrected in Q4 after nearly doubling up during the year

– On the positive side, stock selection supported relative performance in health care

– For the full year, significant gains were broad based, with stock selection in consumer discretionary and IT contributing the most

o Small cash position was only notable detractor from relative performance

– From a country perspective, strong relative performance was driven most by stock selection in China, India, Brazil, and Russia

Market Outlook:

– Looking forward, the team believes recent outperformance by EM and other international equities may be in the early innings

o Many countries are introducing productivity-enhancing reforms

o Political winds have shifted in a market-friendly direction

– As global growth demonstrated clear acceleration in the fourth quarter amid passage of stimulative tax legislation in the U.S. team believes positive overshoot is now underway

o The team has no prediction as to how far the current optimism will advance in the near term

o They believe at some point in the year ahead, markets are likely to see increased volatility and would not be surprised to see first notable correction

– Principal reasons for shift in outlook since last quarter include:

o Coordinated acceleration in global growth and rise in confidence; believe the downside of elevated confidence is a likely rise in future inflation reading and risk of economic overheating

o Energy and commodity prices are recently on the rise along with bond yields in several countries

– Although equity markets are currently embracing the message, they believe it is likely a matter of time before tight labor conditions drive wage inflation

o This could elevate fears of global tightening more than market is currently discounting

– Regarding the policy shift in China, after successful Party Congress meeting, a series of official tightening measures were unleashed

o Takeaway is that liquidity and credit to the property, non-bank financial, and asset management sectors will be further constrained

o Also expect relaxation of consumer credit availability will be partially reversed

o Believe economic and credit growth will like slow on the margin, but financial risks will likely remain contained

– Key implication is that while China represented an upside surprise to global growth in 2017, it may represent a modest drag on growth and earnings expectations in the year ahead

o Team remains focused on longer term beneficiaries

– While a market correction following such a strong year would not be surprising, they continue to believe that EM outperformance is sustainable

o The team remains encouraged by ongoing productivity-enhancing reforms in many EM countries

– Many countries are demonstrating a favorable political shift in direction of investment business and capital market-friendly policies

o Note that most EM economies are less advanced cyclically than U.S.

– Longer term and more secular drivers remain encouraging and we believe our unique forward looking and bottom up fundamental approach position us well moving forward

Performance Snapshot: