HILIX – Q4 2017 Commentary

The Hartford International Value Fund outperformed its index and peer group during the quarter and outperformed the index by over 250 bps in 2017. The team maintains its strong track record by focusing on bottom-up stock selection that, in turn, also drives alpha through sector allocation.

Market Overview:

– International equities posted positive returns in the quarter as economic data across major economies remained largely positive

– In October, the ECB announced a reduction in its monthly asset purchases beginning in January

o Did extend the overall repurchase program through September 2018

– Federal Reserve raised benchmark Fed funds rate by 0.25% in December

o Persistence of low inflation in developed countries continues to surprise central banks and has increased market anxiety over interest rate policy

o Global growth continues and unemployment has decreased

– Nine of the eleven sectors in the Index rose during the quarter

o Energy, materials, and consumer discretionary sectors rose the most

o Health care and utilities lagged the broader index

Performance Review:

– HILIX outperformed the MSCI EAFE Value Index and the Lipper peer group during the quarter

– Sector allocation was the primary contributor to relative performance

o Positive performance from an underweight to health care and overweight to materials

o Detractor was holding no real estate

– Security selection also contributed to relative performance during the quarter

o Selection was strongest in financials and information technology

o Partially offset by weaker selection in materials, which detracted

– Regionally, security selection in Japan contributed while selection in Europe detracted

– Top relative and absolute contributors during the period included Acer and Japan Steel Works

Market Outlook:

– The cyclical rally experienced in the third quarter extended into the fourth quarter

o Energy and materials represented the top performing sectors in the index

– Similar to last quarter, the team used share price strength within information technology and industrials to reduce the fund’s exposures

o Continued to take profits in Japan as several stocks reached price targets

o Ultimately, this reduced the fund’s overweight to Japan

– Largest sector over weights at end of the quarter were information technology, energy, and materials

o Largest underweights were to financials and real estate

o Largest country overweight was still to Japan (despite a relative reduction)

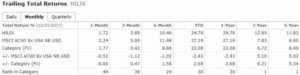

Performance Overview: