HLMEX – Q4 2017 Commentary

The Harding Loevner Emerging Markets fund lagged its benchmark during the fourth quarter, but still returned nearly 37% for 2017. The slight underperformance was driven by a relative underweight to China and an underweight to energy companies. The team builds a geographically diversified portfolio based on industry stock selection rather than country.

Market Overview:

– The MSCI EM Index ended an exceptionally strong year with a return of 7.5% in the fourth quarter, outpacing developed markets

– EM benefited from a confluence of economic and monetary factors in 2017

o Negative sentiment for EM following the 2016 election dissipated as few protectionist policies actually materialized

– Economic growth gained momentum globally giving a boost to trade

– Continued absence of inflationary pressures allowed developed countries to continue easy monetary policy

o Have supported lofty real estate and financial valuations

– US Fed raised rates three time in 2017

o EM took on each of those raises without faltering

– U.S. dollar was generally weaker slipping nearly 10% against a trade-weighted basket of global currencies

o Most EM currencies rose alongside major developed currencies and their strength accounted for about one fifth of total performance in 2017

– EM companies’ earnings growth stood out mainly in the IT sector

o Sector’s results surpassed even most optimistic forecasts

o China’s leading e-commerce, social media, and gaming companies had strongest growth

– By region, Asia contributed over four-fifths of EM returns in 2017

o This was led by China and South Korea

Performance Overview:

– The fund returned 36.8% during the year, trailing the benchmark

o This underperformance came during the fourth quarter when the composite gained 6.3% while the bench was up 7.5%

– This actually was a result consistent with historical patterns as the team’s strongest relative returns have come in times of slower growth

– Given the magnitude of 2017 returns, small cash exposure detracted significantly

– During the year, stock selection in energy and IT detracted the most

o Driven most by an underweight to Alibaba and underweight to coal and oil-refinery companies in energy

– Strong stock selection in industrials, financials, and utilities, and telecom

– Regionally, underweight to Asia was a modest detractor

o Despite having less exposure to China, the fund’s Chinese stocks managed to outperform the benchmark

– Some of the contributing sources during the year nonetheless detracted in the fourth quarter

o Stock selection in consumer discretionary and financials

o Holdings in Latin American banks were the main culprits in financials

– Brazilian banks gave back gains in the fourth quarter

– During the fourth quarter, stock selection was positive in Asia and Europe

Market Outlook:

– The search for companies meeting the high-quality, durable growth criteria of the team is truly a global pursuit as not all countries possess factors supportive of business like in China

o Examples include Brazil and Russia whose poor economic policies have slowed recovery

o Uncertainty continues in Latin America as we await pivotal elections in Brazil, Mexico, Argentina, and Colombia

o While the outlook in South Africa may be improving with new regime, past corruption continues to hurt the economy

– To create a diversified portfolio, the team focuses on companies in industries, not countries, to identify strong businesses that meet high quality, durable growth criteria

o They ensure that the portfolio is geographically diversified to control risk by adhering to portfolio guidelines

– Research leads to investing in superior businesses with the management, sustainable competitive advantages, and financial strength to grow over the long term

– Fluctuations in price relative to estimates and growth drove many of the transactions in 2017

o At the end of the year, portfolio’s sector exposure resembled those in 2016

o Large weights in financials and consumer discretionary and small weights in materials and real estate

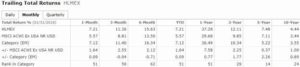

Performance Snapshot: