TIREX – Q4 2017 Commentary

During the fourth quarter, the TIAA CREF Real Estate Securities Fund outpaced the FTSE NAREIT Index and beat the benchmark by nearly 350 bps in 2017. The team benefitted from strong security selection as well as strategic allocation positioning within the retail space.

Market Overview:

– REITs have notched nine consecutive years of gains suggesting that we are in later stages of the commercial real estate cycle

o The fund’s long term focus remains unchanged

o Continue to seek higher-quality growth oriented REITs

o Not all sectors will react the same to being in a later phase of the cycle

– REITs are currently trading in line with their corresponding commercial property values

o Expect real estate returns to be driven by market supply/demand and NOI at the property level

Performance Review:

– TIAA-CREF Real Estate Securities Fund outperformed its benchmark in the fourth quarter

– Fund’s fourth quarter outperformance was driven by security selection in retail, residential, and office REITs

o An overweight in Data Centers also contributed meaningfully as demand for data storage has grown in the U.S. and abroad

– Homebuilder TRI Pointe Group and Storage REIT National Storage were positive contributors

– Not owning two shopping center REITs, Taubman and Macerich partially offset contributors

– Funds full year outperformance was driven by a combination of strong stock selection and sector allocations

o In retail, team benefited from an underweight for much of the year as negative headlines hampered sentiment

o Gradually increasing exposure at discounted pricing allowed team to participate in retail’s fourth quarter rebound

– Exposure to industrials, data centers, and residential REITs also aided

Market Outlook:

– Fund continues to emphasize relative value opportunities within sectors

o Favor high-quality companies with strong growth profiles, good balance sheets, and footprints in strongest metro regions

o Also seek companies that are well-suited for the current market environment or are preparing for the next stage of their own market cycle

– Accordingly, the team maintains data center exposure, which remains attractive given both limited supply and robust secular growth trends

– Trimmed office overweight as the sector faces supply concerns

o Still strategic in the space, focusing on certain geographic locations

– Regional mall exposure emphasizes A-Tier operators that are best positioned in the long run

o Retail’s strong Q4 led the team to reduce the scope of its underweight

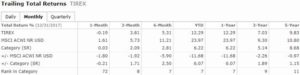

Performance Overview: