EOG reported 4Q17 oil production of -1% vs. high end of guidance and in-line with consensus, while adjusted EBITDA 9% above consensus. The stock consolidated today after disappointing production and capex guidance for 2018. However we think the thesis is intact, as Premium wells now represent the majority of completed wells, FCF outlook is positive even at $50/bbl, and dividend growth has been resumed. Price target under review.

Current Price: $102.4 Price Target: under review

Position Size: 2.3% TTM Performance: +5.6%

- 4Q17 results were good, at the high end of production guidance, and beating EPS expectations thanks to lower expenses and a lower tax rate

- 2017 total crude oil production grew 19%

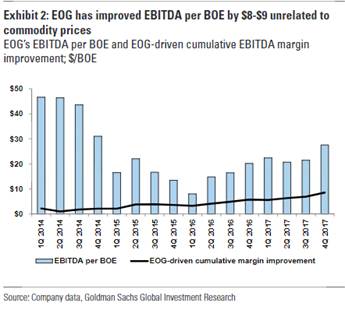

- EBITDA margin was strong, driven by reductions in operating costs and better NGLs realizations

- 2018 production guidance of 16-20% disappoints, but is likely conservative (EOG has met or beaten its high-end guidance in 10 of the last 12 quarters)

- Oil production growth of 18% at the midpoint, with 1Q18 growth being the lowest quarter

- Permian basin activity likely to be brought online later in the year, driving a back-end loaded production growth

- Capex budget of $5.4-$5.8B, +12% higher than estimated ($5B), as there is a mix shift towards higher cost Permian basin exploitation (but with a higher production rate). This trend is not unlike peers

- Well costs to decline by 5% and lower operating expenses by 7%

- EOG is resuming its dividend growth, increasing it by 10%, although it fell below expectations

- $1.5B in FCF for the year at $60/bbl WTI (even at $50/bbl, EOG is guiding to positive FCF generation, and dividend coverage)

- Management intends to use excess cash to repay debt

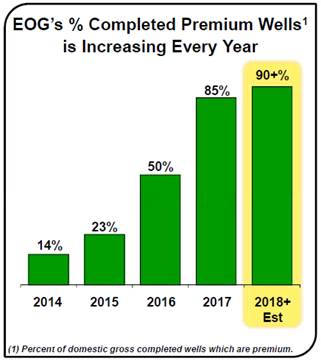

- EOG has held up better than peers as oil prices begin to gradually move upward thanks to their focus on “premium” drilling locations (lower cost of production than peers and higher Return On Capital Employed)

- Estimating a 90% of domestic gross completed wells are premium

- Premium strategy is a permanent change

- All investments are tested in a $40 oil and $2.50 natural gas environment

EOG Thesis:

- EOG is attractively valued relative to future cash flow growth and return potential

- As the leading North American Oil production company, EOG is well positioned to benefit from (1) Secular growth in US shale production and (2) Cyclical rebound in global oil production/oil prices

- We view EOG as a high quality company within a highly cyclical industry – EOG has generated 13% annual Returns on Invested Capital over the past 10 years and offers industry leading cash flow growth potential

- Though not immune, EOG’s stock protects better than most energy stocks on the downside due to its high quality nature – strong balance sheet, ROIC, & cash flow generation

- As such, we view EOG as offering the potential for superior risk-adjusted returns over a market/commodity cycle

$EOG.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!