DBLTX – Q4 2017 Commentary

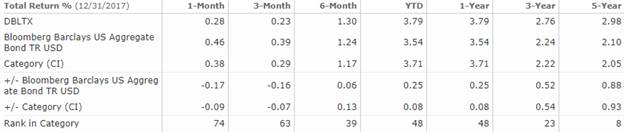

The DoubleLine Total Return Bond Fund lagged the Barclays Agg during the fourth quarter but outperformed for the year in 2017. Gundlach and team continue to favor securitized assets and believe U.S. economic growth should continue through the next year.

I have attached the DoubleLine broad fixed income sector commentary as a reference. This includes a lot of good information across all of fixed income.

Market Overview:

– It was another strong quarter for risk assets to close out the year

o Synchronized expansion in global economic activity across both emerging and developed markets continued to provide widespread gains across a variety of asset classes

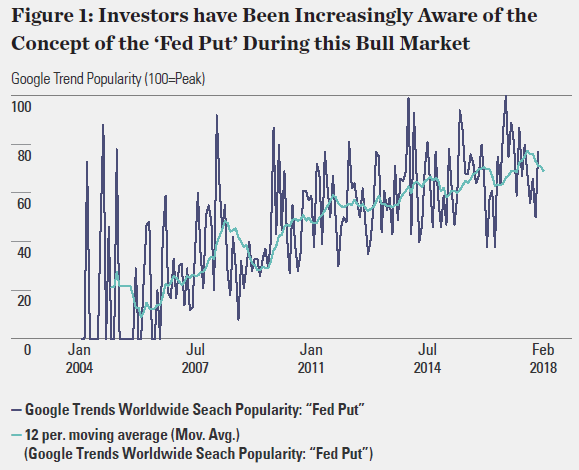

– Reduced level of volatility across U.S. markets was driven largely by continued QE, quantitative easing, accommodative fiscal policy, strong consumer sentiment

– 10 Year UST yields moved slightly lower for the year and the Fed hiked three times

o When the 10 year UST yield began testing the lower end of the range in Q3, Gundlach turned openly bearish on the 10 year given expectations of rising rates

o 10 year hit 2.04 in September and ended the year up almost 40 bps ahead at 2.40%

– Big news during the fourth quarter was the approval of the new tax plan in the U.S.

o Corporate tax rate reduction had positive impact on equity markets

o Time will tell what the long term economic impact will be

– Fed raised rates in December for the third time of 2017

o First time since financial crisis that the Fed followed through on its promise of expected rate hikes

Performance Overview:

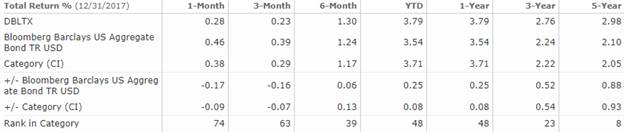

– In the fourth quarter, DBLTX underperformed the Agg by 39 bps

– While all sectors contributed positively to performance, the sell-off in the UST curve impacted valuations across fixed income

– Prices were down across Agency RMBS with longer duration derivative positions

o Inverse floating rate and inverse interest-only securities were worst performers

– Pass-throughs were the best performing in this sector as these investments generated positive total return due to interest income

o Non-agency RMBS contributed positively to performance due to strong interest income

– Subprime securities outperformed as prices increased during the quarter

– Amongst other securitized credit sectors, returns were positive due to interest income

– While prices were down on ABS and CMBS, CLOs

Market Outlook:

– Growth expectations and economic data remains strong in the U.S.

o Unemployment rate held steady at 4.1% which is a 17 year low

– Along with the ongoing downtrend in unemployment, consumer confidence remains strong

o The Conference Board’s Consumer Confidence Index rose to 122.1

– This level is higher than pre-global financial crisis and is indicative of strong consumer sentiment

– The ISM Non-Manufacturing Index dropped to 55.9 from 57.4

o Index level above 50 signals expansion across the respective sectors

– All of this points to an economy that still has room to grow

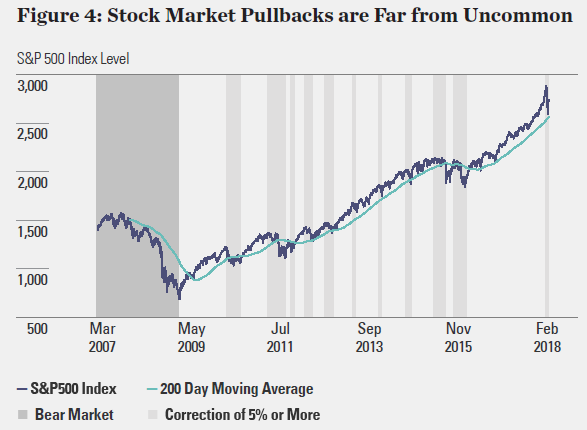

– On a macro level, Gundlach believes that equities are likely to pull back over the next year and he is skeptical about credit

o Does not believe there is reason to expect a recession and likes commodities as a general asset class

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

50 Federal Street, Suite 810

Boston, MA 02110

www.crestwoodadvisors.com

PLEASE NOTE!

On February 26 Crestwood will move to our new located at:

One Liberty Square

Suite 500

Boston, MA 02109

DoubleLine Commentary Q4 2017.pdf