On March 1st, 2018 President Trump announced his intention to impose significant tariffs on steel and aluminum imports. The announcement sent stock and bond prices falling, stoking fears of higher prices and slower economic growth. Protecting domestic industries like steel and aluminum may have raw appeal, but tariffs are flawed in theory and have a history of hurting economic growth. History shows a link between tariffs and populism which last flourished in the 1930’s. President Trump’s proposed tariffs threaten the post WWII global trade order and stock and bond markets are now paying attention.

Tariffs are bad policy

Basic economics instructs that tariffs benefit a select few producers and harm consumers through higher prices as they reduce competition and allow less efficient producers to continue to operate. In 1776, Adam Smith wrote of comparative advantage stating that countries should focus on their low cost production and trade for goods where their costs of production are relatively high. In general, society benefits from trade as wealth rises everywhere.

Tariffs have a consistent history of reducing economic activity and hurting growth. The clearest example is the infamous Smoot Hawley Tariff Act of 1930, which essentially doubled tariffs on over 20,000 imported goods to an average rate over 50%. While this was one of many policy errors that contributed to the depth and length of the Great Depression, there is general agreement that these tariffs made matters worse. The effect of these tariffs on global trade are clear – from 1929 to 1933 world exports collapsed by roughly 55%.

Interestingly, there are many similarities between the 1930’s and today. Populist politicians flourished during both periods due to voter anger at 1) wealth and opportunity gaps, 2) perceived cultural threats, 3) established elites, and 4) claims of the government not working. Both periods have similar economic overtones – low interest rates, low economic growth, stagnant wage increases and high debt burdens. In 1930, over 1,000 economists sent President Hoover a petition expressing their opposition to the Smoot Hawley bill, asking for his veto. President Hoover disregarded the petition due to voter anger at established elites. In a similar fashion, President Trump has ignored the advice of many of his advisors with these tariffs.

Politically, tariffs are easy to implement and hard to remove. One example is the Chicken Tax levied by France and Germany in the early 1960’s. Success of U.S. chicken exports to Europe caused outcries from European farmers who lobbied politicians to tax chicken imports at 25%. The U.S. retaliated by taxing pickup trucks and commercial vans at 25%. Both sides of this tax remain in place today. In the market for sedans, foreign competition has improved car quality and choice for consumers, with even U.S. auto producers compelled to build better cars to compete. Consumers benefit from imports through improved quality and lowered prices for sedans, while competition and improvements for trucks and vans has lagged.

Anticipated effects of taxing steel and aluminum imports

Higher prices. For certain we can expect these tariffs to result in higher prices. Steel and aluminum are key inputs for production for companies in the U.S. Higher raw material prices will put U.S. producers at a competitive disadvantage against foreign producers. In recent stock market action U.S. car and plane manufacturers have been hit hard.

Job losses, not gains. The U.S. last imposed steel tariffs under President Bush in 2002. The project was abandoned after 20 months when a 2003 report estimated that the tariffs cost in excess of 200,000 jobs—more than the total number of people then employed in the entire steel industry at the time. Today, steel makers employ about 140,000 workers while industries that use steel as an input employ some 6.5 million Americans. Transportation industries like aircraft and autos account for about 40% of domestic steel consumption and will have to pay higher prices for steel. These tariffs will hurt U.S. competitiveness globally.

As with the coal industry, automation, not falling production, has been a big part of the secular decline in workers employed. The Wall Street Journal recently highlighted a Voestalpine AG steel plant in Austria that employs 14 people today to produce 500,000 tons of steel a year. That output would have required 1,000 employees in 1960.

Retaliation. Expect the EU and other countries not exempted from the tariff to implement their own tariffs on U.S. goods. Likely candidates include agriculture, cars, motorcycles, airplanes and even Jack Daniels. Foreign politicians will try to hurt the U.S. in very specific ways to invoke the strongest political response. Think chickens = pick-up trucks.

Missed target? By far our largest trade deficit is with China which totaled $375.2 billion last year. President Trump’s steel and aluminum tariffs will not affect China’s trade surplus with the U.S. Canada is hit hardest by these tariffs as they are the largest exporter to the U.S. for both aluminum (56% of U.S. imports) and steel (16% of U.S. imports).

Security threat? President Trump justified the tariffs by claiming our national security was at risk. This broad rationale applies to all countries who export steel and aluminum to the U.S. Prior administrations used tariffs for anti-dumping protection to single out one country who was selling in the U.S. at a price below their cost of production. The ‘national security’ clause is a rarely used nuclear option which sidesteps World Trade Organization rules. The claim is a bit thin as the U.S. imports only 30% of total steel used and all steel used by armed services is produced domestically. By claiming this option the U.S., as the world’s largest economy, has opened the door for other countries to follow. If countries side step existing trading laws and norms, the post-world war II trading order will be in jeopardy.

Markets reacting to political risks

The tariff announcement seemed rushed as evidenced by the disagreement within President Trump’s administration and key committee heads in Congress who were unaware of the details. Speaker Paul Ryan has urged President Trump to reconsider and provide exemptions for certain countries. Until this tariff announcement, President Trump’s actions have been mostly pro-business and pro-growth which has allowed the market to shrug off many of his volatile statements and provocative tweets. Perhaps markets start to pay more attention to his tweets and comments.

Unfair trade?

President Trump evaluates trade relations based on size of current account deficit. Trade deficits do not necessarily make a country poorer as it ignores the effects of the offsetting capital account. Dollars used to buy foreign goods (less the value of our exports) flow back into the U.S. as investment. Since the U.S. trade deficit of the past 10 years has averaged $560 billion per year, there has been a lot of foreign capital flowing into the U.S. Foreign governments own a whopping $6.3 trillion of U.S. Government debt which is 33% of the total government debt. The U.S. benefits through lower interest rates. However, capital flowing into U.S. can be excessive, increase asset prices and in some cases cause asset bubbles. Foreign capital definitely helped fuel the housing bubble from 2004 to 2007. In theory trade deficits will weaken a country’s currency and the trade imbalance will self-adjust, because imports get more expensive and exports get cheaper as the dollar falls. Instead surplus countries have used their dollars from trade to buy U.S. assets averting currency markets, which explains why the U.S. has run a large persistent deficit since 1991. While President Trump’s view of deficits is overly simplistic, there is room to improve trade relations. Instead of harmful tariffs, finding a way to balance capital accounts would lead to more free currency markets and balanced trade.

There are other ways trade can be ‘unfair’. Foreign government subsidies, unconstrained ability to pollute, and cruel labor practices can give foreign companies a big cost advantage over U.S. companies. Socially conscious firms like Whole Foods promote ‘fair trade’ goods for their like-minded consumers. Mandating a level playing field for benefits and working conditions globally would help U.S. workers and improve U.S. relative competitiveness. Admittedly, these changes would be difficult to implement, but Trump’s anti-trade message has resonated with many voters.

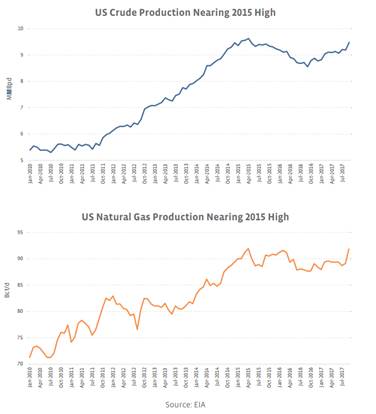

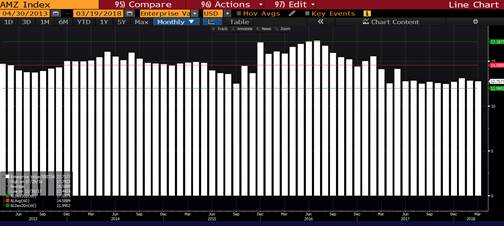

Portfolio

During periods of uncertainty, portfolio diversification is paramount. We continue to be well positioned in high quality and short duration fixed income investments. We expect the trend towards higher inflation will benefit our alternative investments. Higher energy prices are a tailwind for MLPs and real estate managers tend to be good at raising rents to keep pace with inflation. For individual stocks, we continue to focus on companies with strong return on invested capital. While we cannot predict new tariffs, we believe our quality portfolio will weather the ups and downs of the market.

On March 2nd, President Trump tweeted “Trade wars are good and easy to win”. We believe neither to be true.