Good Afternoon,

Attached is the most recent “Uncommon Sense” piece put together by Michael Arone at SSGA. The theme is the recent increase in volatility, and he discusses the following three points:

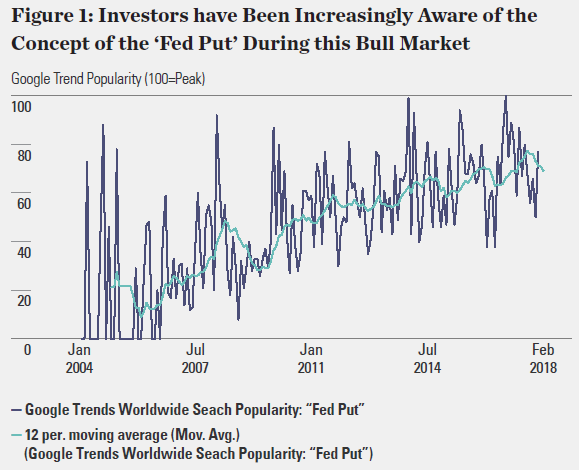

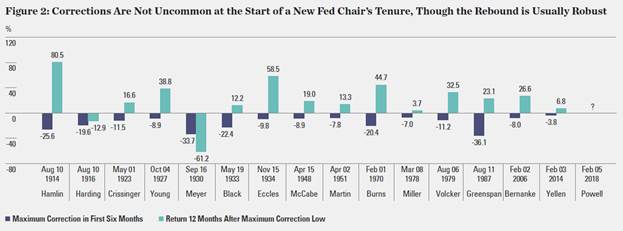

1.) Investors have relied on the “Fed Put” during the market run-up, and he believes this remains in play with the new Fed Chair, Powell

2.) We are still in a Goldilocks market environment, with modest “not too hot, not too cold” growth

3.) Fundamentals continue to be the driver of growth in the stock market, and the numbers continue to be solid

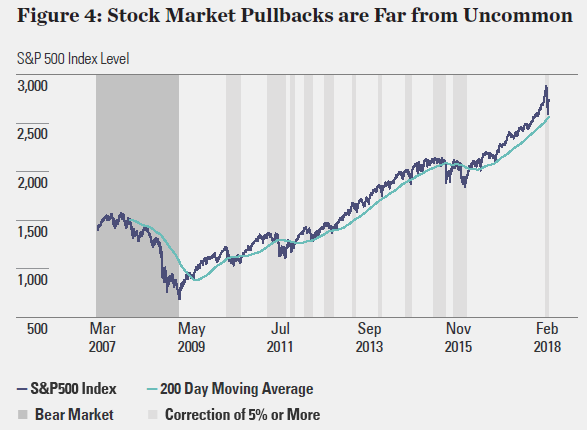

As always, we want to temper client expectations and reactions in the short term but it is notable that, since the market correction earlier this month, global equity markets have already begun to rebound while volatility has fallen.

Below are a few charts from the piece worth sharing:

Uncertainty Caused by new Fed Chair – the Fed “Put” (ability of the Fed to reduce Fed funds rate when markets sell off)

Stock market pullbacks following new Fed Chair are not uncommon

Stock market pullbacks (in general) are relatively common but we had not seen a correction in over two years

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!