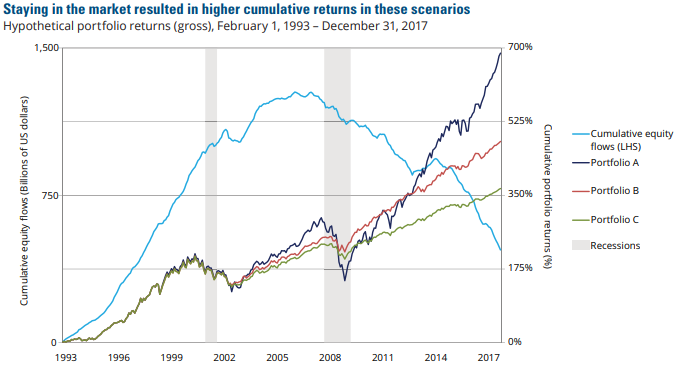

We constantly see different ways to depict the narrative, but I found this interesting. The author uses equity flows as the proxy for investor movements, indicating a “following of the crowd” type scenario.

The simple conclusion drawn from this illustration is that a balanced portfolio that remains balanced over time tends to outperform. The more investors move in and out of cash or “less risky” assets in an attempt to time market movements, the more likely they are to miss out on the upside or lose on the downside.

Just another way to push our long standing belief that investing for the long term in a diversified portfolio makes sense over time.

Scenario Description Based on Equity Flows

Cumulative Returns in Various Scenarios

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!