McCormick (MKC) delivered 1Q 2018 adjusted EPS of $1.00, a 32% increase y/y thanks to recent acquisitions and good product portfolio management. We are encouraged to see good progress on the margin front with continued stable top line growth. Management provided additional details on its cash use following the tax reform. Price target unchanged.

Current Price: $108 Price Target: $117

Position Size: 2% LTM Performance: +6%

Thesis Intact. Key takeaways from the quarter:

1. 1Q 2018 sales results were up 15% ex-FX, including a +12% impact from RB Foods and Giotti

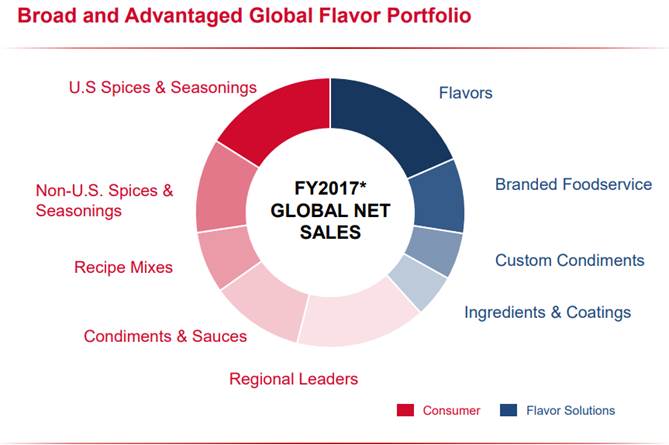

a. Consumer segment up 15% ex-FX (+1.3% volume/mix, +0.7% price). China and better product mix led the growth

b. Flavor Solutions (prior Industrial) segment: +15% ex-FX (+1.8% volume/mix, +0.6% price). The elimination of low margin businesses impacted sales this quarter

c. Adjusted operating income grew 38% ex-FX, expanding margins by 250bps. The drivers to the margin expansion were:

i. the accretive impact from acquisitions

ii. the portfolio shift to higher margin products

iii. cost savings initiatives

iv. lower SG&A expenses from sales leverage

d. Adjusted EPS growth of 32%, mostly from better operating income growth and lower taxes, but some of the benefit was offset by an increase in interest expense (post acquisitions)

2. 2018 guidance raised from an additional 100bps FX impact and lower tax rate

a. Organic sales growth target of 3-5% (unchanged). Total sales to increase 13-15% y/y

b. Adjusted gross margin to increase 150-200bps (unchanged)

c. Tax rate guidance lowered to 23% from 24%

d. New adjusted EPS guidance of $4.85-$4.95, from $4.80-$4.90, growing 14-16%

e. MKC announced plans to reinvest a portion of the tax savings into a one-time $1,000 bonus payment for its US employees in May, as well as accelerate wage increases. Other use of incremental cash from the tax reform are strategic investments, returning cash to shareholders and debt down payment

3. Valuation: no reason to change the price target on recent guidance changes

a. MKC offers a current run-rate real cash yield of ~4%: 2% dividend yield + 2% buyback yield

The Thesis on MKC:

• Industry Leader: McCormick & Company (MKC) is a leading manufacturer of spices and flavorings. MKC has been in business for 120 years and the founding family still has ownership interest

• Growth opportunity: Spice consumption is growing 3 times faster than population growth. With the leading branded and private label position, MKC stands to be the biggest beneficiary of this global trend

• Offense/Defense: MKC supplies spices to major food companies including PepsiCo and YUM! Brands giving it a blend of cyclical and counter-cyclical exposure

• Balance sheet and cash flow strength offer opportunities for continued consolidation through M&A in the sector

$MKC.US

[tag MKC]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!