Travelers (TRV) reported Q4 EPS of $2.46 below consensus of $2.67. The shortfall was due to storm losses – March nor’easters, California mudslides and winter storms in the UK – and weakness in business segment margins. Traveler’s underlying combined ratio was 92.4%, with strong retention rates and positive renewal premium charge. Travelers raised the dividend 7%. Travelers is a high quality, disciplined underwriter of insurance that is focused on returning capital to shareholders. Thesis intact.

Current Price: $133 Price Target: $150

Position Size: 2.3% TTM Performance: +11.9%

Thesis Intact. Key takeaways from the quarter:

- Results were solid considering losses

- Solid premium growth 5% and retention rates of 86%

- Renewal premium renewal increase was 4.5% indicating some strength in pricing. JP Morgan speculated we could be seeing an inflection point in pricing.

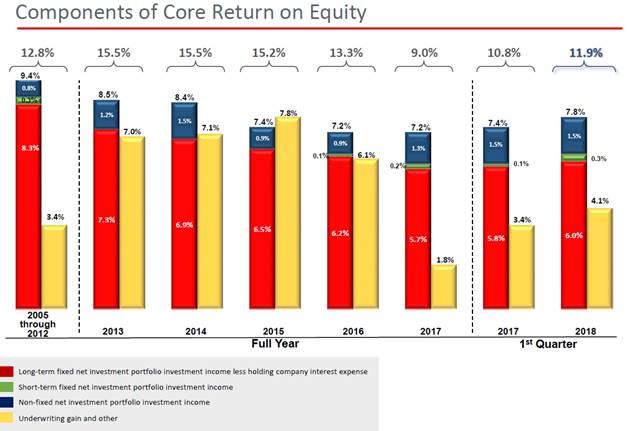

- Q1 ROE 11.9% which increased from 10.8 YoY. Investment results benefitted from higher interest rates and lower tax rate

- Balance sheet strength shows quality of underwriting

- Debt to capital ratio of 23.4%

- High quality investment portfolio – only 2.7% below investment grade

- Favorable reserve development for all years in all segments

- TRV continues to aggressively return capital to shareholders – $549 in total – $351m buybacks during Q4 as part of a $5b share repurchase agreement and $198b in dividends.

- Real yield over 10% (Buyback 8.5% + 2.3% Dividend)

- Over the past five years, an average of 93% of annual free cash flow has been returned to shareholders for a reduction in shares of 34% – wow!

- Travelers book value fell -3% YoY due to impact of higher interest rates on unrealized gains

- Valuation has improved at the margin but we continue to view TRV as fairly valued (2018 P/E 12.7) relative to current ROE and BV growth – in the context of the broader market environment – and given the balance of slower pricing offset by a robust 10% real shareholder yield

The Thesis on TRV:

- We expect TRV will be able to grow book value per share in the mid-single digits over the near-medium term, and generate ROE in the 10-14% range

- Industry leader with disciplined underwriting and investment portfolio track record

- Consistent returns in the low to mid double digits

- Responsible capital allocation and proven desire to act in the best interests of shareholders

($trv.us)

John R. Ingram CFA

Managing Director

Asset Allocation and Research

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109