As I mentioned in this morning’s meeting, attached is the updated Guide to the Markets from JP Morgan. I have included some of the most timely and relevant charts below.

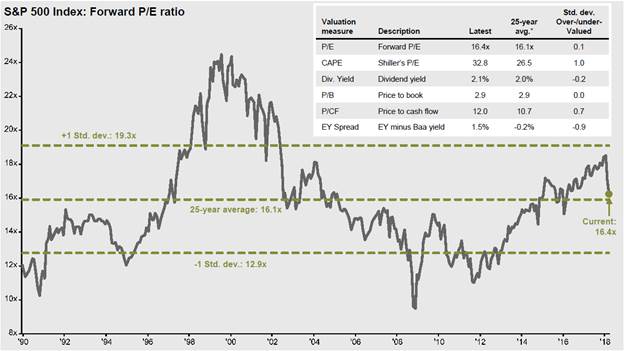

S&P Valuations have become more “normalized” but CAPE P/E still 1 S.D. above historical average

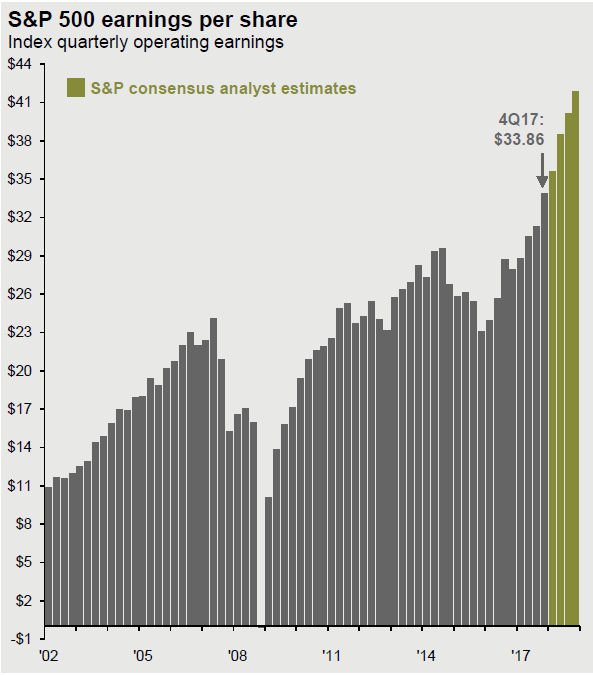

Earnings growth continues to improve in the U.S.

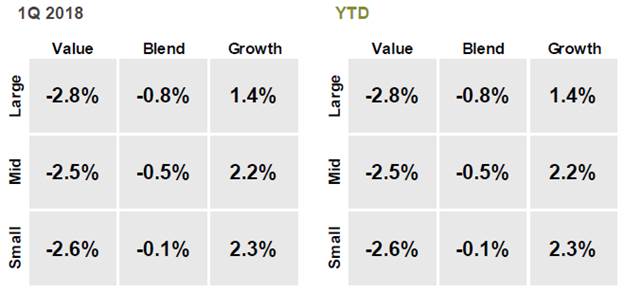

Over the past year, growth has outperformed value; this has turned slightly in recent weeks

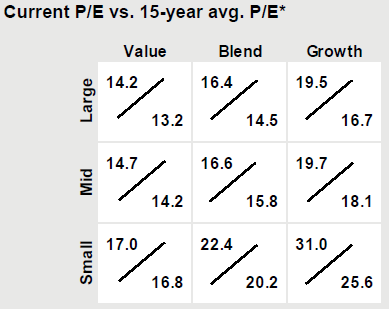

Valuations have come down as earnings expectations grow and prices fall

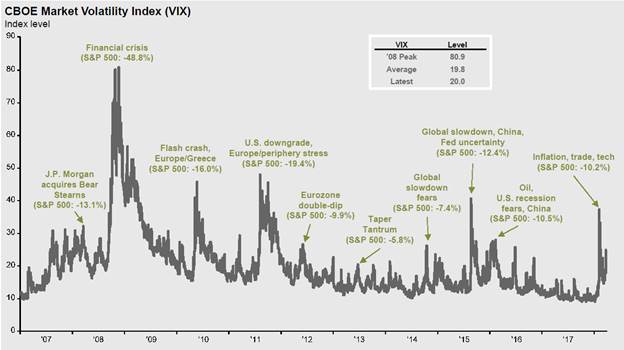

As we expected, volatility increased already in 2018; some choppiness is normal over time

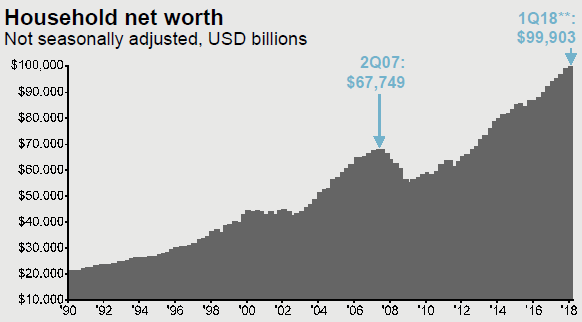

Individual net worth continues to increase, indicating a strong consumer

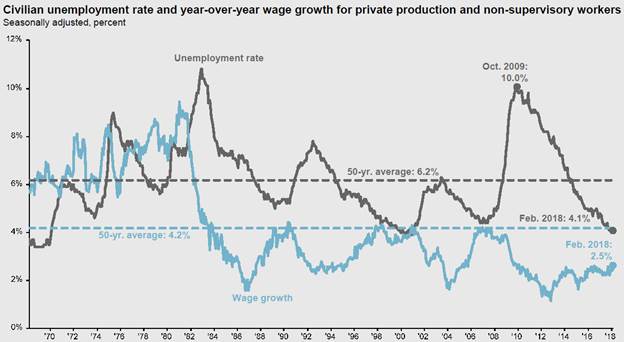

Unemployment rates continue to fall and we have seen a slight pickup in wage growth

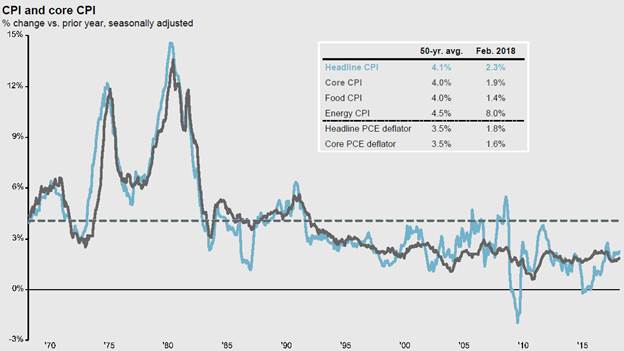

CPI has increased (higher inflation) but we are still well below historical averages

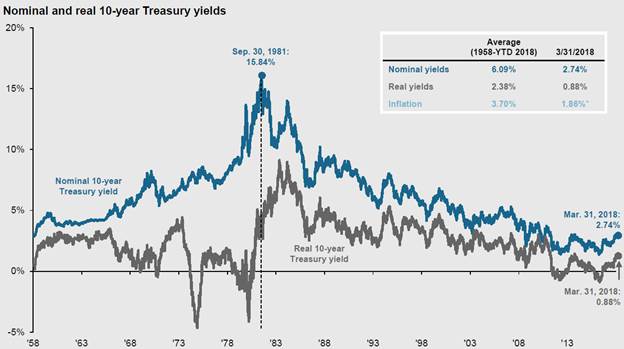

Nominal vs. Real Yield; payout from fixed income remains low

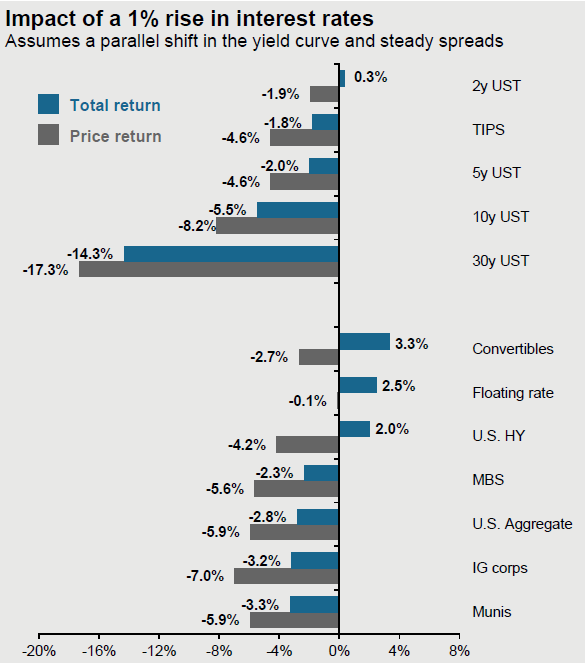

Effects of duration: what a 1% rise in interest rates means for different fixed income vehicles

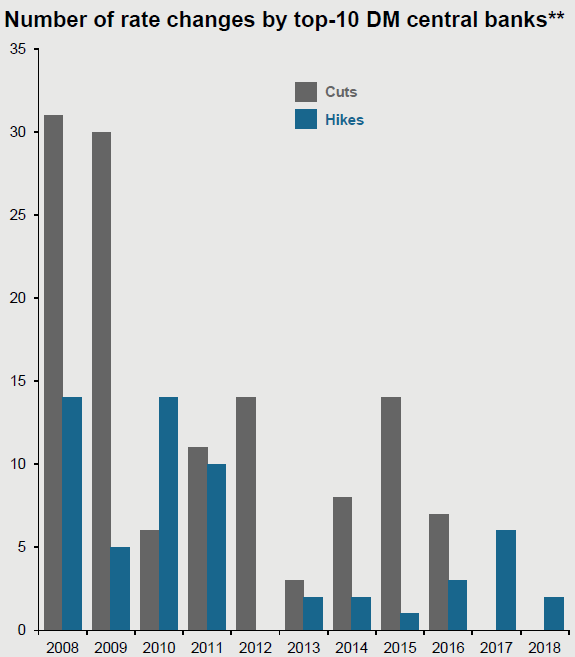

Monetary easing is slowing down in developed markets

We are in a period of synchronized global growth

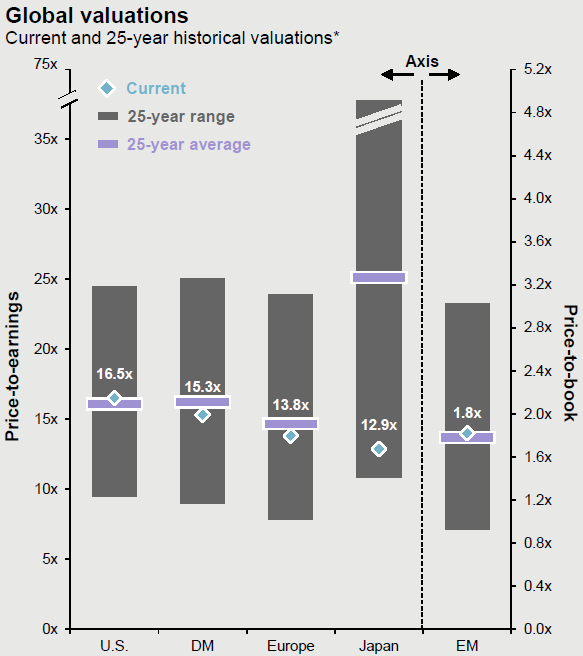

Global valuations are at more “normal” levels; Developed and EM still slightly “cheaper” than U.S.

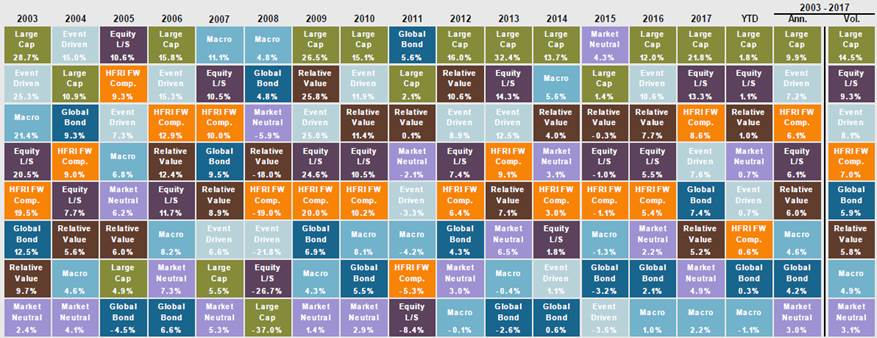

Hedge Funds – interesting that simple “large cap” hedge funds have had the best returns over time

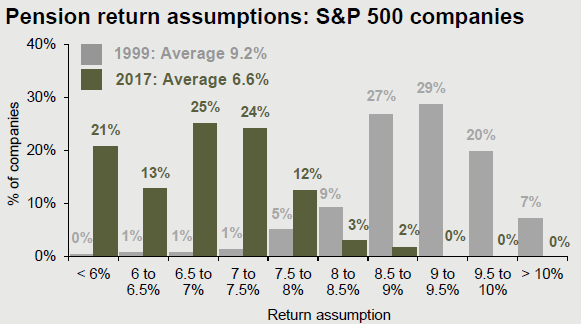

Annualized return assumptions have decreased substantially over the past 20 years

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!