HLMEX – Q1 2018 Commentary

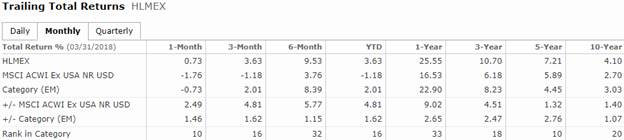

Harding Loevner Institutional Emerging Markets had a strong quarter outperforming its benchmark and a large majority of its peers. The strategy benefited from strong stock selection and remains cautiously optimistic about current synchronized global growth. The team continues to drive alpha through its focus on high quality growth companies.

Market Overview:

– Emerging markets rose modestly amid a return of volatility

o Investors appeared torn between the strength of company fundamentals and emerging threats to cyclical economic expansion

– Strong employment reports in the U.S. and Japan presaged higher wage inflation

o Fed fear that global interest rates may rise faster and further than expected

– Global trade war threat emerged as Donald Trump announced import tariffs on aluminum and steel

o Caused retaliatory measures from China and EU

– Volatility was especially high in the tech sector

o Sector twice during the quarter rose and fell more than 10%

– Energy provided the strongest returns, as Brent oil sustained prices in the $65-70 range

– Health care saw strong returns from leading South Korea and Chinese drug companies

– Latin America was the best-performing region on strong returns in Brazil and Peru

o Brazilian market spiked after court upheld conviction of former president da Silva

– Performance varied widely across Asian Markets

o Thailand and Pakistan posted strong returns and China was roughly in line with index

Performance Overview:

– EM Composite rose 3.1%, ahead of the 1.5% return of its benchmark

– Focus on high quality companies contributed to outperformance while growth tilt had a modest yet positive impact

– Stock selection was strong in financials, consumer discretionary, utilities, and staples

o Lagged in Health Care and IT

o Largest relative contributing sectors were financials and utilities

– Regionally, China and Russia were the largest drivers of relative performance

o South Korea and Taiwan were largest relative regional detractors

Market Outlook:

– Two years into an extended rally, EM maintained its upward trajectory

o Last year’s strong returns were spurred by synchronized global economic growth, rising commodity prices, and acceleration in corporate earnings growth

– Inflation across EM remains benign and current account deficits are narrower

– In China, the government has reduced risks reining in credit growth and moderating capital outflows

– Many EM countries are earlier in the upward stage of the business cycle than the U.S. and other developed markets

– EM financial sector’s strong performance may be signaling a positive outlook for credit demand

– EM equity outlook for market returns appears more balanced now than last year

o Positive factors are more fully reflected in share prices

o Investors have to account for rising rates and possible global trade wars

– The team does not position the portfolio based on political of economic forecasts

o However, they remain aware of the environment

o They differentiate between what they can reasonably foresee and what they cannot

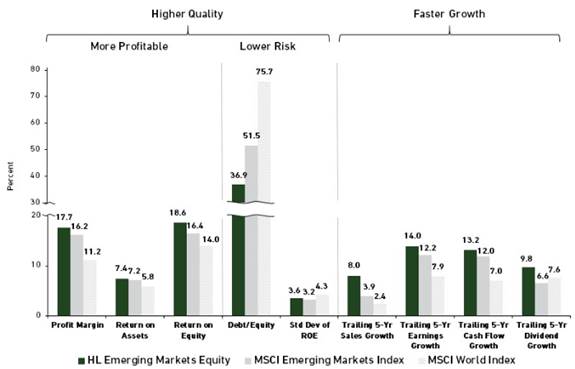

– Outperformance has been broadly driven by the team’s focus on higher quality, faster growing companies

Performance Review:

Focus on higher quality growth companies

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!