Thesis Intact. Key Takeaways:

Yesterday MMM reported its 1Q18 results, with sales and EPS in-line, but margin missing (30bps expansion vs. 100bps expected). While EPS met consensus expectations thanks to a lower tax rate, and healthy reported sales growth of 7.7% (+2.8% organic – and all five segments in positive territory), management reduced its top end of organic sales growth guidance for 2018 to 3-4% (from 3-5%), and the top end of EPS guidance by $0.15. A guidance cut this early in the year drove the stock down on the news. In particular, its Industrials segment (1/3 of sales) fell short of expectations, with a sales deceleration to +2.2% from 5.7% last year. The auto aftermarket (auto body shops) was weak – although not new news as it was previously called out in March. But recall that IHS forecasts a return to positive global auto production for the rest of the year, which should support its auto OEM business (+3% in 1Q). Oral care saw weak demand (flat y/y), and electronics experienced a deceleration in growth.

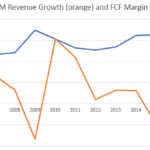

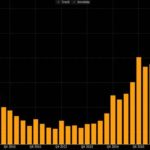

On the positive, 3M’s pricing increase (+70bps) showed the company’s strength and sustained margins expansion, but this needs to be monitored as raw material inflation continues through 2018 and pressures margins. The management team raised its buyback target to $3-$5B from $2-$4B before. MMM remains a best-in-class industrial company, as proven by its improving ROE and consistent FCF margin (even during the last recession – see charts below).

· Valuation: we have updated our model and do not change our price target at this point.

[tag MMM]

Bloomberg’s industrials end markets look healthy (updated 4/17/18)

Thesis on MMM:

• Strong brand name, history of successful innovation, scale and low cost advantage help to drive above average returns.

• International expansion and pipeline investment should drive mid-single digit top line and high single digit bottom line growth. Emerging markets represent 47% of sales today and should reach 50% by 2020.

• The company is in good financial position and has a strong history of share buybacks, dividends and acting in the best interest of the shareholder.

• Quality management team with a decent incentive structure.

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!