Thesis Intact. Key takeaways:

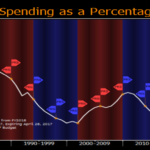

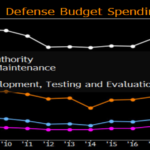

Lockheed Martin released its 1Q18 earnings well above consensus expectation both on the revenue and earnings front. The management team also raised its sales (+0.7%), operating profit (+2%) and EPS (+3.9%) for the year. Yet the stock sold off as investors were expecting a lift of its 2018 cash flow guidance as the FY18 DoD budget grew, in particular the 2018 Appropriation Act offering an incremental $7B for Lockheed’s programs. The management team did not know if those incremental dollars will translate in new contracts/sales and preferred to remain conservative this early in the year. Production plans still target 90 F-35s delivered in 2018, with peak delivery year in 2025. There is an on-going dispute with the DoD over some production issue but this is not impacting revenue, and we do not think this will be a big problem to solve. Its Sikorsky business saw a nice margin expansion, most likely thanks to cost cutting and synergies flowing through post acquisition. The pension contributions are always a big part of defense companies’ expenses, and LMT is no exception. Management is guiding to the possibility of negative cash from operations in Q2 due to most of the pension contribution being made by Q3: $1.5B was made in Q1 and the full year amount will reach $5B.

Overall we keep a positive view of this holding.

Valuation: we are not changing our price target, a review of our model warrants a $374 price target.

LMT Thesis:

· Lockheed Martin is a primary beneficiary from the replacement cycle for aging military aircraft and ships

· Excellent management team focused on returning capital to shareholders

· Strong cash flow and financial position

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!