Thesis intact. Key takeaways:

Pepsi reported good organic revenue growth (+2.3%) with emerging markets strength (+HSD sales growth) lifting the company’s growth this quarter. On the negative side, North America Beverages continues to face tough competition, but results improved sequentially – in the eyes of the CEO, this is a short term problem and they “know exactly how to fix it”. The gross and operating margins were weaker, with input costs inflation impacting the company (a theme we have heard from others as well). Some responsible pricing will help offset cost inflation this year. Management is guiding to a continued gross margin compression through 2018, which has typically been offset by SG&A productivity. However this year the company will increase spending to fend off competition (Coke but also smaller players). Cola is the only category Pepsi has been outspent recently, which they intend to fix to keep their market shares. The lower tax rate will instead be used to maintain earnings growth. Pepsi is maintaining its 2018 guidance.

There has been pressure for Pepsi to break its business into 2 companies: beverages and food. PEP’s CEO reiterated the importance of having both businesses together, as it is used as a bargaining tool with their customers (retailers): beverages has a high velocity in store, which is attractive to retailers (drives traffic). When warranted, beverages are sold in pair with salty snacks (salt makes you thirsty J). They also view their bottling business as a utility company that has low margins but creates lots of cash.

Pepsi remains a key holding in our consumer staples sector.

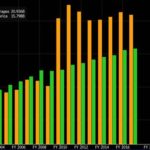

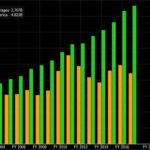

Pepsi Frito Lays and North America Beverages sales (left chart) and operating margins (right chart): Frito Lay is clearly a growth driver, while NAB results shows the intense competitive nature of the category:

Valuation:

- ~5% real cash yield (~3% dividend yield and 2% buyback yield). Pepsi is returning 100% of free cash to shareholders. We are maintaining our price target after review of our model.

Thesis on Pepsi:

- Global growth opportunity with about 40% of profits coming from outside the US. CSD is only 25% of sales (and Pepsi brand only 12%)

- Strong market share in high growth emerging markets where there is low penetration and rising per capita consumption

- Resilient snack business provides pricing power and visibility to future cash flows (more than half of sales are from snacks not beverages). CSD is only 25% of sales (and Pepsi brand only 12%)

- Several Great brands driving global growth: Frito Lay, Quaker, Gatorade

- Strong balance sheet and cash flows support a solid dividend yield and share buyback program

$PEP.US

[tag PEP]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above