Thesis Intact. Key Takeaways:

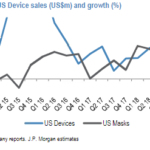

Overall results were good, with sales up 11% ex-FX, but EPS missed slightly due to one-time restructuring charges. Resmed is guiding to growing its SG&A costs at half the rate of its revenue. The recent growth in the rest of the world was driven by recent funding policy changes in France and Japan favoring connected care solutions, where Resmed has an advantage over other competitors that would struggle with the investments required to develop a good connected care solution. The new funding rules favor their AirSense devices pushing suppliers to upgrade their fleets (this trend should persist for the medium term). On the other hand, we see its US results as a slight negative, as RMD has recently lost some market share to Philips who had a double-digit growth this past quarter vs. RMD +8%. The next quarter will determine if this is an ongoing trend to be worried about or if the company’s innovation ability is intact.

Valuation: no change at this time

- The stock is supported by a ~3.2% FCF yield, and a stable dividend (current yield 1.5%). The company expects to buy-back at least enough shares to offset the dilution from share issuance

- The balance sheet is strong (net debt/EBITDA at 0.17x)

Thesis on RMD:

- Leading position in the underpenetrated sleep apnea space

- Duopoly market

- New product cycle

- Returns of capital to increase: ~1% share buyback/year (back in FY18), dividend yield of 2%

$RMD.US

[tag RMD]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!