Over the weekend, T-Mobile and Sprint officially announced a merger where T-Mobile would purchase Sprint for $26 billion in an all-equity deal. The deal still must be approved by the DOJ, and broadly analysts believe the odds of this exact deal being passed are about 50/50.

Because there is little certainty around that outcome, we will assume that the merger is going to take place. As I mentioned Friday, the major issue for CCI and other tower companies is the decommissioning of sites where Sprint and T-Mobile have shared or integrated networks.

While the headline risk centers on decommissioning of towers, there are several potential positive catalysts driven by the goal of improving 5G capabilities.

Potential Negatives:

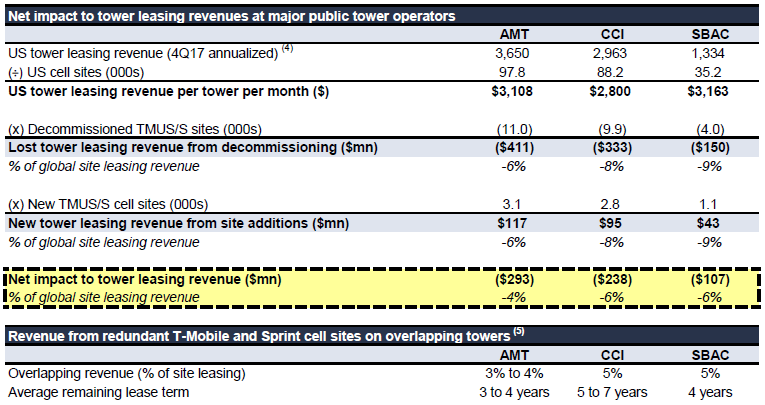

Below is a chart from Goldman Sachs that breaks down the estimated negative impact on tower leasing revenues. This assumes a net decommissioning of 25,000 towers (35k current decommissioned with plans to build another 10k). Goldman estimates a 6% net loss in tower leasing revenue over time.

T-Mobile and Sprint represent 19% and 14%, respectively, of Crown Castle’s consolidated site rental revenues. Further, Crown Castle derived approximately 5% (accounting for 1% previously disclosed non-renewals) of its consolidated site rental revenues from each of T-Mobile and Sprint on towers where both carriers currently reside.

Potential Positives:

– The emphasis on 5G, and the accelerated pace to grow the capabilities, is a key “selling point” for the deal to be made. The combined company plans to spend $40 billion in total capital investment over the next three years aimed at integrating and expanding its 5G network.

– The new company plans to eventually have 50,000 small cells, more than 5x the number that they currently operate; this is a positive for CCI, one of the largest providers of fiber infrastructure supporting small cells.

– The timing of the decommissioning is unknown. It is possible that, for the next 2-3 years new sites could outpace decommissioned sites and actually incrementally increase rental revenue over that time frame.

$CCI.US

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!