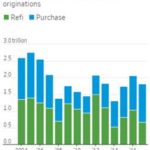

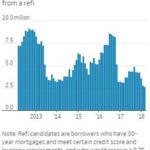

They beat on top and bottom line and reiterated full year guidance. Revenues were up 5%, slightly ahead of expectations. The street is at the high end of their guidance for the year. They continue to face some headwinds, but their pipeline of new business is solid which provides some reassurance on top line growth going forward. Drivers for the business primarily include new client wins, mortgage originations and total active loans. Their pipeline is strong with several new customer wins reported (e.g. added JPM to their originations solutions pipeline), but the pace of implementation has been a source of disappointment as the process for migrating new customers onto their platform, often from in-house or highly customized solutions, can be complex and slow. This was the cause of their guide down last quarter. Additionally, similar to last quarter, rising rates are negatively impacting mortgage originations, with industry volumes down 14%. That drop is driven by lower refinancing activity which now makes up 37% of originations – that’s the lowest proportion of total originations since 1995. In 2012 that proportion was 72%. This will continue as rising rates mean fewer people will be in a position to benefit from refinancing. This is a headwind in their Software Solutions segment (~85% of revenue), though originations make up only 10% of revenue and servicing is 75% and much steadier. Refi’s are a sub-segment of that 10% and, given pent-up demand in housing, purchases are going to start to outpace this. Overall, Software Solutions segment revenues were up 5% as servicing grew 7% and originations declined 4%. On the servicing side, they continue to dominate first lien loans with 62% share and are growing share in second lien loans. At the end of 2017 they had 13% share of second lien, they now stand at 17% share and expect to reach 30% once current commitments are implemented. Mortgage servicing costs continue to rise and should aid growth in this business as potential cost savings are an impetus for banks to adopt BKI’s software. Data analytics segment (~15% of revenue) revenues were up 3%. Growth going forward in this segment should be ~3-5%. M&A continues to be a focus, especially with the new CEO.

Valuation:

· Trading at over a 5% FCF yield is reasonable given growth potential, strong ROIC with a recurring, predictable revenue model and high FCF margins, which are supported by high incremental margins and capex (~9% of revenue now) which should taper as they grow.

· Balance sheet is in good shape with a leverage ratio of 2.9x.

· Capital allocation priorities include opportunistic share repurchases, debt pay down and potential acquisitions.

Thesis:

- Black Knight is an industry leader with over 50% market share of the mortgage servicing industry.

- Stable business with 80% recurring revenues, long-term contracts and high switching costs.

- BKI has high returns on capital and high cash flow margins

- We expect high single digit revenue growth and double digit EBITDA growth.

$BKI.UA

[tag BKI}

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!