Fairfax’s reported strong Q1 2018 operating earnings of $3.96 versus $3.11 last year. Book value grew a healthy 4.9% for the quarter boosted by strong investment results. Insurance results were solid with organic premium growth of 7.1% and a combined ratio of 96%.

Current Price: $ 549 Price Target: $580

Position Size: 1.6% TTM Performance: +23.4%

Thesis Intact. Key takeaways from the quarter:

- Insurance results

- 96% combined ratio with underwriting profit of $109m. All major insurance companies had combined ratios less than 100 (which means they made a profit). Favorable prior reserve development of $86m.

- Average annual reserve redundancy of 3.5% over past 7 years

- Insurance operations hold $22.7b in float ($819 per share)

- Incredibly well capitalized firm 23.8% debt (up from 18% due to Allied acquisition)/ capital and 8.0x interest coverage

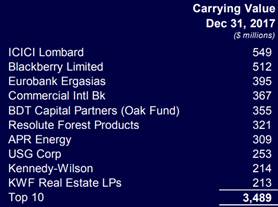

- Investment portfolio

- Holding company continues to hold a 50% cash.

- Firm has broadened its equity holdings and reduced IBM position.

- Firm has a large position ($114b notional value) in CPI-linked derivative, which will protect the company from a Japan-like scenario as well as potential debt solvency concerns. However, this position has recently been a drag on investment returns.

- Looking to improve 5-year returns on investment portfolio of 2% to historical levels of 8% or better

- Valuation:

- Fairfax trades at a discount to other P&C stocks at 1.2x BV.

- Shareholder yield of over 5.7%. Over the past 6 months Fairfax bought back $543k worth of shares. If you annualize that level, the share buyback yield is 4.0% with a dividend yield of 1.7%

The Thesis on Fairfax:

- Fairfax is a disciplined insurance underwriter with an excellent investment track record

- Unmatched book value growth – 19.5% for past 32 years

- Attractive valuation and well above average management team

- Defensively positioned balanced sheet

$FRFHF.US

John R. Ingram CFA

Managing Director

Asset Allocation and Research

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109