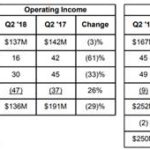

Aramark reported 2Q18 earnings, beating on the top and bottom line and raising the midpoint of EPS guidance. Revenue was up 6% constant currency with about 2% organic growth. The quarter included partial results from AmeriPride and a full quarter of Avendra. The key positive was the improvement in adjusted operating margins in conjunction with top line growth as the two together have been elusive. Importantly, the margin expansion was led by their core US food service business in contrast to their competitor Sodexo’s profit warning on inflation and increased competition. Sentiment was bad heading into the quarter as Aramark has had trouble hitting their organic growth and margin targets. In 2017, they disappointed with organic growth, but saw margin expansion. Then last quarter they saw meaningfully improved top line growth at the expense of 50bps in margin contraction. This was largely blamed on the onboarding of new contract wins. Management says they are on track to hit the FY18 7.2% margin target that they set in 2015, though with much of it back half weighted (implies a 7.9% adj. op. margin in 2H18 vs 6.5% in 1H18). Legacy growth was slightly below long-term target for 1Q, but they said they expect the legacy business to hit their “at least 3%” target for the full year. For 1H18 they are at 3.4%. Without adjustments, their operating profit would have been down almost 30%. Some of their adjustments and the capitalization of certain client related costs are a source of skepticism around the validity of their margins. This margin concern has been reinforced by profit issues at Sodexo and talk of rising delivery costs from their primary distributor, Sysco. Specifically, client contract incentives represent cash payments for renovations of client facilities – this hits the capex line and is in “other assets” on the balance sheet (net of accumulated amortization it’s close to $1B). Adj. operating income adds back that depreciation and, in doing so, added 80bps to the 2Q adj. operating margin. Longer term, their acquisitions will help with margins through increased purchasing scale with Avendra and better capacity utilization and route density with AmeriPride.

Valuation:

· On a P/E basis they trade at a discount to peers, history, and the S&P 500.

· On a FCF basis they trade at a little over a 4% forward FCF yield.

· Balance sheet is pretty decently levered but should improve. With recent acquisitions, leverage has ratcheted back up to 4.7x – they target 4.5x by year end and 3.5x by 2020.

Thesis:

· ARMK is an industry leader in the food, facilities, and uniform outsourcing market. The market is large and growing supported by favorable outsourcing trends.

· Aramark has an opportunity to continue expanding margins driven by productivity initiatives and operating leverage. The stock currently trades at a trough multiple vs. the market and at

a discount to peers which I expect to mean revert thanks to low double digit EPS growth for the next few years driven by margin improvement, deleveraging, and improving top line.

· ARMK is well positioned to weather economic cycles due to a diversified customer base and greater than half of their revenues coming from non-cyclical industries. As deleveraging continues shareholder returns should increase via dividend growth and buybacks.

$ARMK.US

[tag ARMK]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!