TORIX – Q1 2018 Commentary

During the quarter, Tortoise MLP & Pipeline Fund underperformed its benchmark. The MLP and broad energy sectors sold off during the quarter due to negative sentiment as well as uncertainty following a FERC ruling. The team remains optimistic about the space believing that commodity prices will remain stable and that companies are better positioned to self-fund capital projects. As of the end of last month, the TTM yield of TORIX is 3.09%.

Market Overview:

– The broad energy market had a volatile start to the year with strong performance in January

o Turned sharply negative in February before returning to positive territory in March

o Net return for energy sector was -5.9% during first quarter

– Despite the recent volatility, there is reason for optimism in 2018

o Driving optimism is that commodity prices will remain stable and drive increased production

o Balance sheets are stronger

o Companies are better positioned to self-funded capital projects reducing reliance on the health of the capital markets

– Midstream energy companies faced structural headwinds during the first quarter along with negative sentiment within the overall energy market

o Other income oriented asset classes also retreated

Performance Overview:

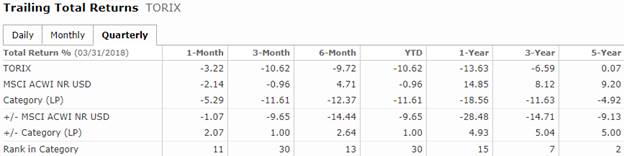

– During the period, TORIX returned -10.62% compared to its benchmark at -9.65%

– A top contributor during the period was ONEOK, Inc.

o Announced increased growth projects at expected high returns and fully funded equity needs

– Another top contributor was Plains GP Holdings, LP

o Expected crude oil production growth from the Permian Basin

– One of the top detractors Williams Companies, Inc.

o Sold off due to the FERC regulation overhang

– Another top detractor was Kinder Morgan, Inc.

o Sold off due to regulatory uncertainty on TransMountain Project

Market Outlook:

– On March 15, the FERC ruled against an existing policy allowing MLPs to include an income tax allowance in cost-of-service rates

o Removal of this allowance may result in a lower tariff rate and ultimately lower cash flow for affected pipelines

– The change only affects pipelines with interstate natural gas and crude oil pipelines operating on a cost of service basis

o Pipelines using negotiated or market based rates are unaffected

– The team believes that structural headwinds are transitory and midstream fundamentals are healthy

– Outlook for midstream sector remains strong as the need to build out new pipeline capacity remains

o Project capital investments in MLPs, pipelines, and related organic projects at approximately $117 billion for 2018-2020

– These projects will facilitate need to takeaway capacity to accommodate the growth in crude oil, natural gas, and natural gas liquid production

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!