I have attached the Monthly Market Monitor put together by Eaton Vance. As always, I recommend taking a look through the full presentation if you have the time. However, I have included a few helpful charts below.

Month: May 2018

Black Knight 1Q18 Earnings

They beat on top and bottom line and reiterated full year guidance. Revenues were up 5%, slightly ahead of expectations. The street is at the high end of their guidance for the year. They continue to face some headwinds, but their pipeline of new business is solid which provides some reassurance on top line growth going forward. Drivers for the business primarily include new client wins, mortgage originations and total active loans. Their pipeline is strong with several new customer wins reported (e.g. added JPM to their originations solutions pipeline), but the pace of implementation has been a source of disappointment as the process for migrating new customers onto their platform, often from in-house or highly customized solutions, can be complex and slow. This was the cause of their guide down last quarter. Additionally, similar to last quarter, rising rates are negatively impacting mortgage originations, with industry volumes down 14%. That drop is driven by lower refinancing activity which now makes up 37% of originations – that’s the lowest proportion of total originations since 1995. In 2012 that proportion was 72%. This will continue as rising rates mean fewer people will be in a position to benefit from refinancing. This is a headwind in their Software Solutions segment (~85% of revenue), though originations make up only 10% of revenue and servicing is 75% and much steadier. Refi’s are a sub-segment of that 10% and, given pent-up demand in housing, purchases are going to start to outpace this. Overall, Software Solutions segment revenues were up 5% as servicing grew 7% and originations declined 4%. On the servicing side, they continue to dominate first lien loans with 62% share and are growing share in second lien loans. At the end of 2017 they had 13% share of second lien, they now stand at 17% share and expect to reach 30% once current commitments are implemented. Mortgage servicing costs continue to rise and should aid growth in this business as potential cost savings are an impetus for banks to adopt BKI’s software. Data analytics segment (~15% of revenue) revenues were up 3%. Growth going forward in this segment should be ~3-5%. M&A continues to be a focus, especially with the new CEO.

Fairfax Q1 2018 results

Fairfax’s reported strong Q1 2018 operating earnings of $3.96 versus $3.11 last year. Book value grew a healthy 4.9% for the quarter boosted by strong investment results. Insurance results were solid with organic premium growth of 7.1% and a combined ratio of 96%.

Current Price: $ 549 Price Target: $580

Position Size: 1.6% TTM Performance: +23.4%

Thesis Intact. Key takeaways from the quarter:

- Insurance results

- 96% combined ratio with underwriting profit of $109m. All major insurance companies had combined ratios less than 100 (which means they made a profit). Favorable prior reserve development of $86m.

- Average annual reserve redundancy of 3.5% over past 7 years

- Insurance operations hold $22.7b in float ($819 per share)

- Incredibly well capitalized firm 23.8% debt (up from 18% due to Allied acquisition)/ capital and 8.0x interest coverage

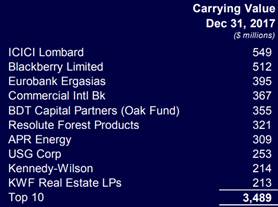

- Investment portfolio

- Holding company continues to hold a 50% cash.

- Firm has broadened its equity holdings and reduced IBM position.

- Firm has a large position ($114b notional value) in CPI-linked derivative, which will protect the company from a Japan-like scenario as well as potential debt solvency concerns. However, this position has recently been a drag on investment returns.

- Looking to improve 5-year returns on investment portfolio of 2% to historical levels of 8% or better

- Valuation:

- Fairfax trades at a discount to other P&C stocks at 1.2x BV.

- Shareholder yield of over 5.7%. Over the past 6 months Fairfax bought back $543k worth of shares. If you annualize that level, the share buyback yield is 4.0% with a dividend yield of 1.7%

The Thesis on Fairfax:

- Fairfax is a disciplined insurance underwriter with an excellent investment track record

- Unmatched book value growth – 19.5% for past 32 years

- Attractive valuation and well above average management team

- Defensively positioned balanced sheet

$FRFHF.US

John R. Ingram CFA

Managing Director

Asset Allocation and Research

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

BEXIX – Q1 2018 Commentary

BEXIX – Q1 2018 Commentary

The Baron Emerging Markets Fund underperformed relative to its benchmark during the first quarter. This relative performance was driven by poor stock selection, particularly in India. The team believes it is positioned for a rise in market volatility and would look to capitalize on opportunities that tend to arise in such environments.