We had been waiting for Fortive’s next deal following the divestiture of its Automation & Specialty business to Altra for $3B. It was announced last night with the acquisition of JNJ’s medical sterilization unit for $2.7B. The deal is expected to close by early 2019. The EBITDA from the new business will offset the loss from the divested Automation business. The deal will be financed by cash on hand, new debt and/or equity.

What is the JNJ’s Advanced Sterilization Products business?

· Provides innovative sterilization and disinfection solutions and low temp hydrogen peroxide sterilization technology:

o Terminal sterilization: Manufactures capital equipment as well as accompanying proprietary sterilant cassettes, biological indicators and software that sterilize critical devices including laparoscopic and robotic instruments and stainless steel instruments. Installed base of >21k units with 8-10 year life.

o High-level disinfection: Manufactures cleaners, reprocessors and biocides for semi-critical devices such as endoscopes. Installed base of >9k units with 6-8 year life cycle.

o Services: Provides maintenance and repair of sterilization solutions ensuring critical uptime for hospitals.

· Global market leader with 80% recurring revenue base (in line with FTV growth strategy), a large installed customer base and good brands

· Provides entry into the medical sterilization and disinfection market:

o Strong growth sector

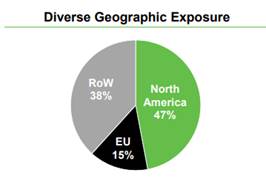

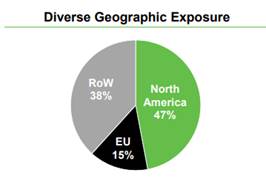

o International growth

· Expected to achieve 10% ROIC in 4 years

This unit hasn’t grown in the several years, in a market that grows mid-single digit. Being part of a large corporation such as JNJ, the unit might not have been a critical business the company was focused on. With $775M in sales last year, it is in line with FTV’s business unit size in the $1B range. EBITDA margin is 25%, which should be accretive to FTV right away.

We see this deal as positive for FTV, expanding its exposure in the non-cyclical medtech sector.

$FTV.US

[tag FTV]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

PLEASE NOTE!

We moved! Please note our new location above!