Key Takeaways:

JNJ reported 2Q18 earnings results that beat consensus thanks to very strong Pharma sales (+17.6% organic). Medical Devices grew 1.9% organic, still experiencing weakness in diabetes and Ortho. Their consumer segment is still showing weak growth, but the re-launch of the baby care business in the US should help lift sales in the coming quarters. JNJ has now experienced its 5th consecutive quarter of sales growth acceleration, as new drugs gains are over time offsetting older drugs facing generics competition (although 2H18 should see increased generics pressure). Guidance for operational sales growth in 2018 is up slightly, now 4.5-5.5% from 4-5%, and EPS guidance was lifted by 2 cents. Reported numbers will see more impact from currency however. As Pespi’s CEO did last week, JNJ’s CEO mentioned their recently released ESG report “Health for Humanity” during his presentation.

· Pharma: organic sales growth of 17.6% especially in oncology (+38.7% from multiple drugs: Darzalex, Imbruvica and Zytiga). JNJ is also accelerating the growth of its Actelion’s acquisition. JNJ sees this growth as sustainable thanks to a strong product pipeline.

· Medical Devices: organic sales growth +1.9%, supported by its interventional solutions business, while diabetes care saw a 17.5% decline (pump discontinuation and price decline). Its Orthopaedics business was weak (-3%) mostly in knees (think Stryker’s Mako competition) and in Spine (share decline and divestiture of Codman). JNJ’s vision business did well +9.6% thanks to its disposable contact lenses Oasys.

· Consumer: organic growth was weak once more (-0.4%), impacted by baby care destocking in stores ahead of the relaunch in the US, and some competitive pressure (not new). Over the counter and women’s health had positive growth (+3.7% and +2.2% resp.)

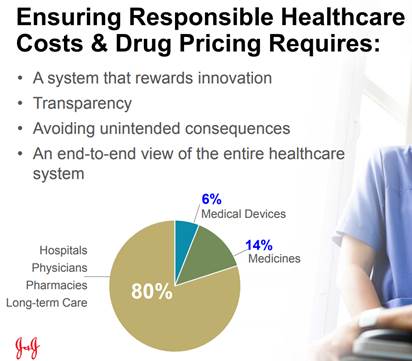

· Health care costs: JNJ has seen a decrease in net prices for the products in their portfolio (-4.6% pricing after rebates and discounts of nearly $15B). Word of caution: JNJ didn’t say what the pricing was before rebates.

Valuation: no change

- Stock is supported by a ~5% FCF yield and a 2.4% dividend yield

- J&J needs to execute on its recent acquisitions in order to see its P/E multiple expand back to its past 5 years average of 16.5x

Thesis on JNJ reiterated:

- High quality company with consistent 20% ROE, 4+% FCF yield,

- Investments in the pipeline and moderating patent expirations create a profile for accelerated revenue and earnings growth

- Growth opportunity: Medical Devices and Consumer offer sustainable growth and potential for expansion internationally

- Strong balance sheet that offers opportunities for M&A.

[tag JNJ]

$JNJ.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!