CVS is seeing some pressure today as the FTC chairman said Aetna and CVS shouldn’t get a free pass because this is a vertical integration. Just a reminder that UnitedHealth is already a vertical integration at play, and has never been highlighted as being anti-competitive.

There are also comments coming from a proposed regulation entitled “removal of safe harbor protection for rebates to plans or PBMs involving prescription pharmaceuticals and creation of new safe harbor protection” (wow that was long to type!). Details are not currently available. This is yet another push from the Trump administration to reform the healthcare system. Drugmakers are seeing pressure too and trying to avoid damages to their business models: Pfizer and Novartis recently announced holding off raising prices for the rest of 2018, in response to Trump’s attacks.

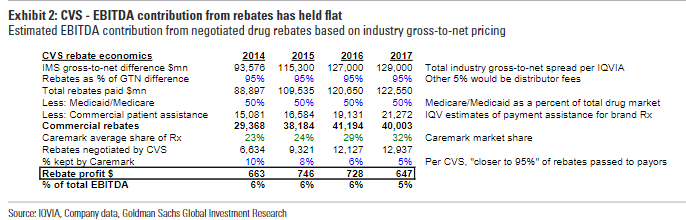

As a reminder, a key function of the PBM is to leverage scale and competition to reduce drug costs for clients. PBM keep up to 10% of the “saving”, although CVS mentioned being closer to 5%. Per Goldman Sachs, the rebates business represents a mid-single digit % of its EBITDA. Below is Goldman’s calculation:

[tag CVS}

$CVS.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!