Key Takeaways:

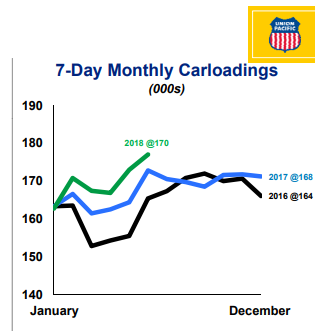

UNP reported revenue growth of 8%, but an operating ratio of 63% above consensus of 62% (lower is better). Fuel prices had a negative impact on margin of -100 bps (fuel costs +48% y/y), as the company passes on the increased fuel expenses to clients with a lag. The services related costs increase offset the productivity gains this quarter. UNP noted some one-time challenges that impacted performance: a tunnel collapse being out of service from May 29 to June 20 (this added 4-5 days for some freight as trains had to be re-routed), and train-crew shortages (which is improving). While those costs should persist in 3Q, overall 2H should show some productivity gains. Another negative point highlighted during the call was the decline in Permian volumes Frac Sand, as local sand mines come online. Freight revenue experienced positive performance: +4% volume (accelerating from 2% in 1Q18), +2% core pricing, +3.5% fuel surcharge, and a -1% mix impact. Free cash flow was better than expected, but helped by lower capex than estimates. The management team is more positive in its business environment outlook, and lifted its volume growth guidance for 2018 to low-to-mid single digit growth (from low single digit).

Volume growth will be supported by:

o future plastic shipments (chemical plants coming on stream)

o truck drivers shortages pushing conversion to rail in intermodal

o e-commerce supporting shipment of parcels.

So far UNP is being lifted by positive trends lifting volumes and prices, but a couple of one-time items impacted its productivity, masking any improvement in its operating ratio. We will monitor the fuel cost increase to make sure it is being passed on to customers in the coming quarters. We are not lifting our price target at this time, as we need to see its operating ratio improve at this stage of the economic cycle.

Segment comments:

· Agriculture: strong demand for ethanol exports, feed grain strength

· Energy: increased shale drilling activity, strong demand for petroleum products, continued coal headwind (due to low natural gas prices)

· Industrial: strong pipe demand, solid industrial production growth

· Premium (includes intermodal & auto): tight truck market, auto parts strength & increased vehicle sales (positive for Sensata!)

Valuation: price target $145 unchanged

· The company continues to return capital to shareholders, buying back $4B shares in 2017 (4% reduction in share count), and distributing ~$2B in dividends (2% yield)

· The balance sheet is still solid, with leverage below 2x

Investment Thesis:

1. Pricing power: Railroads offer 4x the fuel efficiency of trucking per ton-mile of freight – a secular tailwind

2. History of compelling long term shareholder returns

3. Industry leading operating ratio and improving ROIC driving returns to shareholders via dividends/buybacks. Real shareholder yield of 6.5% (2.5% dividend yield, 4% buyback)

[tag UNP] $UNP.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!