Key Takeaways:

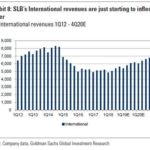

Schlumberger 2Q18 earnings results were generally in line with expectations, with revenue +6% quarter/quarter, and margin +75bps q/q. Technology and software, differentiating factors for SLB’s margins, were offset by startup costs and transitory operational delays. Cameron (offshore activity) is slow to rebound, but should contribute to growth in 2018-2019. Management had a positive outlook for its international business, seeing positive pricing trends, projecting it to strengthen in 4Q. Initial guidance is for double digit growth in its international business in 2019, while capex needs remain at $2B, lifting the company’s FCF. Its equipment will be fully deployed by the 4th quarter, setting the stage for greater pricing power in 2019. However, its North American geography is projected to get worse before it gets better. During the quarter, SLB repurchased 1.5M shares. On the negative side, 3Q18 guidance came below consensus, with EPS up 10-15% q/q. Overall we are pleased with the results, and believe patience is key with this stock to see improving free cash flow.

SLB Thesis:

1. After 5 years of significant underperformance, The Energy Sector is historically cheap and SLB is

historically cheap relative to the sector – despite being one of the highest quality Energy companies

in the world

2. As the leading Global Oil Services company, SLB is well positioned to benefit from (1) Secular

growth in U.S. shale production and (2) Cyclical rebound in global oil production/oil prices

3. SLB is a high quality company within a highly cyclical industry – SLB has generated 16% annual

Returns on Invested Capital over the past 10 years and throws off a lot of free cash flow

4. SLB’s stock is highly levered to increasing oil prices and will not wait for the turn to make its

move. We are also getting closer to a bottom in EPS estimates and SLB protects better than most

energy stocks on the downside due to its high quality nature – strong balance sheet, ROIC, cash

flows

$SLB.US

[tag SLB]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!