Key Takeaways:

MMM reported 2Q18 revenue that were better than expected, with EPS in line after removing the one-time gain from the sale of its Communications Markets business. Revenue grew +7.4% y/y (+5.6% organic ex-FX), gross margins expanded by 120bps y/y, and operating margin increased 100bps mostly from better volume and productivity actions. Sales growth was broad based, with all segments seeing organic growth. Some of the beat this quarter was due to US customers accelerating their purchases ahead of an ERP roll-out in the US in Industrials, Safety & Graphics and Electronics & Energy (this has been implemented in Europe in the last 18 months). The impact from this implementation is a +50-100bps of growth pulled forward to 2Q18. Adjusted EPS grew 27% y/y thanks to organic growth, productivity efforts and a lower tax rate.

MMM returned $2.4B to shareholders via dividends and share repurchases this quarter. The management team increased the lower end of its share repurchase guidance to $4-5B from $3-5B.

The stock initially sold off as the management team adjusted its top-end EPS guidance for the year due to the sale of a business, but recovered since as the underlying fundamentals remain strong. Overall MMM has some good momentum in its pricing power, offsetting raw-material inflation. The new tariffs have little effect so far on the company’s costs, only estimated at 1c/share. However the management team is monitoring the impact from any increase in tariffs and possible retaliations, and could change sourcing and/or pricing increases if necessary. We are not changing our price target or position size at this point.

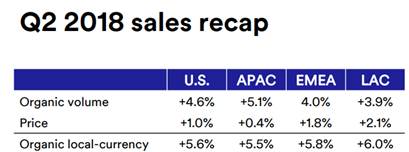

Sales growth per regions:

2018 guidance:

· 3-4% sales growth organic ex-FX (M&A +1%, FX +1%). 3Q18 should see the lowest growth for the year, on tougher comps and some of the sales pulled forward into 2Q

· $10.20-10.45 GAAP EPS. The higher end of the EPS guidance was reduced by 10 cents due to lower FX benefits and the sale of its Communications business.

· 20%+ ROIC

· 90-100% FCF conversion

· 15c/share benefit from the share buyback (prior guidance was for 10-15c/share)

Thesis on MMM:

• Strong brand name, history of successful innovation, scale and low cost advantage help to drive above average returns.

• International expansion and pipeline investment should drive mid-single digit top line and high single digit bottom line growth. Emerging markets represent 47% of sales today and should reach 50% by 2020.

• The company is in good financial position and has a strong history of share buybacks, dividends and acting in the best interest of the shareholder.

• Quality management team with a decent incentive structure.

[tag MMM] $MMM.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!