BEXIX – Q2 2018 Commentary

Baron Emerging Markets fell 9.35% during the quarter, underperforming the broader EM index. Relative underperformance was driven largely by a single position in a Malaysian e-service provider. The selloff within EM has been caused by a withdrawal of liquidity driven by cheap US dollar funding as well as increased rhetoric around protectionist measures coming out of the U.S. The Baron team believes that many major EM countries have undergone a positive and supportive evolution of political direction recently, and their differentiated stock selection process should be able to take advantage of recent increased volatility.

Market Overview:

– Emerging Markets notably underperformed the US and global indices in the second quarter

– Team believes the recent quarter was unusual as several unpredictable geopolitical events acted as catalysts

o EM is clearly advancing along the path of a correction, with certain markets and currencies appearing already quite advanced

– Would characterize the deterioration of EM equity performance as multi-pronged

o Broad withdrawal of liquidity particularly in the form of cheap dollar funding in non-US markets which has continued to slowly recede

o Risk of more aggressive protectionist measures which has served to amplify existing tightening of financial conditions in several international markets

o Reversal of macroeconomic and liquidity conditions in countries that are early in addressing fiscal or current account imbalances has threatened positive political momentum in these markets

Performance Overview:

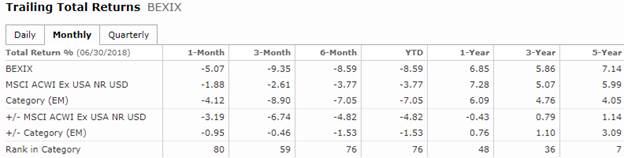

– Baron Emerging Markets fell 9.35% in the second quarter and trailed its index by 139 bps

– On a country basis, higher exposure to better-performing equities in India, China, and Mexico and lower exposure to lagging equities in Turkey, Thailand, Brazil and Indonesia added value

– Positive effects were offset by underperformance in Argentina, India, Malaysia, Russia, and Korea

– On a sector level, health care and telecom contributed most to relative performance

o Health care outperformed after increasing 2.4% as a group

o Higher exposure to better performing pharma stocks contributed to relative results

– Tech, energy, and materials holdings hampered relative performance as deteriorating macro conditions in Brazil and Argentina accounted for the majority of the weakness in these sectors

o Stock selection in IT detracted over 100 bps driven mostly MyEG which fell almost 70% following surprise Malaysian election results

Market Outlook:

– Believe an improvement in trade tensions or moderation of Fed tightening is likely required before a return to EM leadership

o However, they suspect conditions could improve relatively quickly

– Not revising the view that many major EM countries have undergone a positive and supportive evolution of political direction the recent years

o Suggest likelihood of improved relative earnings growth and equity performance

– Believe the scope of the anticipated correction may be larger than anticipated, but beginning to see value and opportunity emerging in Brazil, Mexico, Indonesia, and Thailand

o Stand prepared to take advantage of market volatility in the coming months and remain optimistic about their differentiated discipline and process

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!