LISIX – Q2 2018 Commentary

Lazard International Strategic Equity performed in line with the MSCI EAFE Index during the second quarter and has outpaced the benchmark by approximately 300 bps YTD. Flat performance for the asset class was driven by geopolitical concerns in Europe and fears of protectionist policies from the United States. The portfolio team remains confident that, by continuing to focus on stock selection of companies with sustainably high or improving returns, the strong long term track record of the strategy can continue.

Market Overview:

– International equities were broadly flat in the second quarter

– There were some areas of significant weakness

o In Europe, political developments in Italy renewed structural Euro Zone fears

o Fears over protectionist tariffs from the United States added weakness

– In emerging markets, continued tightening of US dollar liquidity saw pressure on the currencies and markets of weaker countries

o This affected Turkey, Mexico, and Brazil

– This environment saw broad pressure on financial stocks

o Financials lagged sharply as did other cyclical industrial stocks

– More defensive sectors such as healthcare and consumer staples did better, while technology stocks mainly continued to prosper

Performance Overview:

– Lazard International Strategic Equity Portfolio performed broadly in line with the MSCI EAFE Index during the second quarter

– In the industrials sector, strong results came from aerospace companies

– In the tech sector, gaming stock Ubisoft continues to benefit from the improving industry dynamics

o Global IT services provider Accenture reported strong results

– Weakness in semiconductor company Taiwan semiconductor continues to be impacted by weakness in Apple’s latest iPhone

– Oil stocks took advantage of an improving environment

– British American Tobacco remained weak on fears over structural change in tobacco

– Pharma company Genmab was hurt by the failure of a speculative clinical trial

– Japanese company Daiwa House was undermined by cyclical fears

Market Outlook:

– On the macro side, data is still broadly encouraging with sentiment indicators close to highs in the United States and Europe

o This is buoyed by credit growth and the prospect of US tax cuts and the French reform

– Benign commodity market and increased confidence is feeding into strong industrial demand

– Chinese consumers are still spending, helped by rising personal credit

– Some market valuations do look stretched leaving overall market direction dependent on reasonable economic growth

– Starting to see upward pressure on interest rates and wages, potentially impacting margins and asset prices given the overwhelming amount of debt on public and private balance sheets

– Any prolonged rise in the USD is particularly troublesome

o Have already observed signs of stress in emerging market currencies

– Political change in Italy and increasingly worrying protectionist statements from the US are unhelpful for the global economy or markets

– Portfolio team remains confident that continued focus on stock selection will help to maintain the strong long term track record

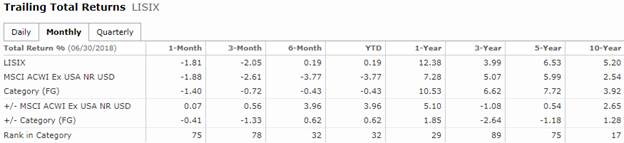

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!