MWTIX – Q2 2018 Market Commentary

The MetWest Total Return Bond Fund outpaced the Agg in the second quarter as the index sold off just slightly. The team is optomistic about the current state of fixed income markets but notes a few cautionary risks that may be ahead. They continue to find value in high quality investments in well collateralized areas of the market.

Market Overview:

– Encouraging signs continued to appear across the macro spectrum in the second quarter

o GDP growth picked up slightly and strength persisted in corporate earnings

o Long dormant pricing pressures surfaced as Core PCE Index hit 2%

o Additioanlly unemployment fell to 3.8%

– The statistics tell a very good story but not necessarily one likely to carry on much longer

– Thematically, there is less accomodative Fed policy, resulting in higher short-term rates and a recession-hinting flatness to the U.S. Treasury Curve

o A rise in the dollar and incresed protectionist policies will make for lower growth prospects in the U.S. and globally

– Volatility has increased this year relative to historically low levels in 2017

o This is likely to weigh on confidence and slowly reset risk premiums higher

– Equities resumed their ascent after a flat first quarter

o Consumers seemed to shrug off the aforementioned risks

– Backdrop of rising rates proved a headwind for the Agg

– Investment grade credit captured some sense of the riskier market elements falling nearly 1%

– High yield was flat for the quarter but not yet in correction territory

– Agencies and Treasuries were up slightly during the quarter

– Even the weaker performers are not fully reflecting the deteriorating fundamentals

Performance Overview:

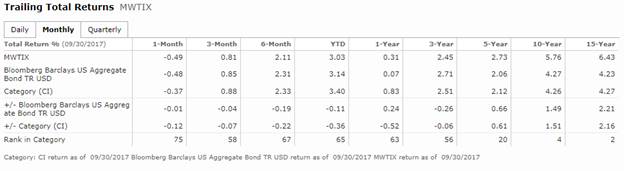

– Returns were slightly negative for both MWTIX and Agg during the quarter yet the fund outperformed by about 10 bps

– Realtive perofrmance was driven mostly by an underweight to credit

o Credit lagged the index by 90 bps given substantial spread widening

o Underweight to indsutrial credit was most beneficial

– An underweight to agency MBS weighed on performance as the sector outpaced the index during the quearter

o Emphasis on agency backed CMBS weighed on performance

– Fund continued to see small contributions from international holdings including Japanese T-bills

– This span of recovery and expansion is the second longest in history, extending well beyond the typical timeframe

o Characteristics suggest we are close to the end than the beginning of the cycle

– History suggests that a turn is generally after a tightening in monetary policy

– Looking into the second half of the year, risks in combination with full valuations make markets vulnerable to dosnside repricing

Market Outlook:

– The fund remains committed to a disciplined, value-based approach relected in a focus on higher quality better-collateralized areas of the market

– Securitized products remain an emphasis and positioning favors high quality, more senior issues

– Non-agency MBS remains one of the more attractive opportunities in fixed income given the defensive nature of an asset that continues to de-lever

– Agency MBS offers many positive attributes including high quality, liquidity, and some yield premium versus Treasuries

o Also faces significant potential headwind of slackening demand as the Fed reduces its holding of the bonds

– With wariness of embedded risks in the corporate credit market, the fund emphasizes more defensive sectors better equipped to withstand volatility

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!