Key Takeaways:

Sensata (ST) reported strong 2Q18 earnings, with sales up +6.4% on an organic basis (+8.8% reported), EBIT margin expanding 100bps and adjusted EPS up 14.8%. Higher volume, lower integration costs and acquisition synergies were cited as driving those results. The management team lifted 2018 organic sales guidance to +5-7% (from 3-5%) and EPS guidance to +14-15% (from +9-13%), thanks to better underlying business trends. The 2H18 run rate is expected to be better than 1H18 (~4%). The company will be able to offset the Section 232 tariffs (steel & aluminum) impact on EPS by the end of 2018 (worth $0.03-0.04/share in 2018). ST has a global supply chain and has been proactive in working with customers before the tariffs implementation. We can expect another share repurchase program to be voted early 2019, as the remaining $400m share repurchase should be done in the next 6 months. The company is reducing its cash balance in China to mitigate the currency risks. After this quarter, we remain confident in Sensata’s growth trajectory and maintain our price target.

Segments review:

· HVOR: sales +14.3%, which is 660bps growth above the end market production (expects FY18 growth of 7-8%).

· Industrial: sales +7.6%. Cross-selling opportunities. Strong demand from North American and Asian customers. Aerospace solid fundamentals

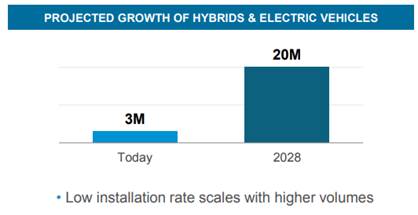

· Auto: sales +3.9%. Electrified vehicles regenerative braking wins (2x higher sensor content than traditional braking), China robust content growth, North America auto driven by turbo-charged engines, new wins in Europe in gas powertrains. It is great to hear that the content per vehicle on electrified vehicles is similar to internal combustion engines, which is a good sign for future growth opportunities for ST. In addition to this good news, ST mentioned the content growth on gas engines offsets the diesel engines decline.

The Thesis on Sensata

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

$ST.US

[tag ST]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!