Key Takeaways:

After a strong quarter of earnings and market share gains, management raised its 2018 outlook for organic sales growth by 50bps to 7-7.5%, and EPS by 1%. Overall the quarter was solid and consistent with its history, showing a top line growth of +6.9% organic, adjusted operating margin +70bps (30bps above consensus) and EPS +15%. We maintain our positive view on the stock.

Why is the stock down today?

· Stock was up >10% YTD, trading at a 1.7% FCF yield and 27.5x current P/E

· 3Q18 guidance came below consensus numbers

· Their Knee business missed consensus by a small 0.5%, but as a well-publicized driver of growth for the company, and with recent competitors’ weakness in that space, expectations were high. Still, we argue that Mako showed a utilization rate growth of 55% y/y.

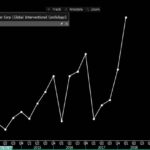

Market share progression for Stryker (Bloomberg data):

SYK Thesis:

- Consistent top and bottom line growth in the mid and upper single digits respectively

- Continued operating leverage of current infrastructure

- Strong balance sheet and cash flow used in the best interest of shareholders

$SYK.US

[tag SYK]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!