Key Takeaways:

Exxon reported disappointing 2Q18 results, with lower production than expected due to heavy maintenance activity, leading to an earnings and cash flow miss. During 1Q18, the company had called for 2Q18 to show lower production rate, however expectations were for a higher number. This quarter, the management team sees 2Q18 to be the bottom in Downstream production, while Upstream should see a gradual improvement (thanks to maintenance recovery and Permian growth). Permian and Bakken production were up 30% y/y (and 45% sequentially). FY18 production guidance is now -4.5% (prior guidance was for production to be flat) on asset sales impact, maintenance outages and reduction of lower value exposure (US gas). On the positive side, XOM guided to production growth in 3Q and 4Q. We remain cautious however on how transparent this management team wants to be, as their positive outlook for downstream during their latest Analyst Day never mentioned the heavy maintenance activity that was scheduled for this past quarter. During the call, the analyst community requested to the company to provide more transparency on scheduled maintenance projects, so that production forecasts can include those outages. We maintain our $86 price target after review of our model.

· Capital spending: management reiterated the benefits they see from investing now, to avoid high decline rates in the future due to insufficient investments. They see value accretive opportunities that are the best they’ve seen since the Mobil merger in 1999.

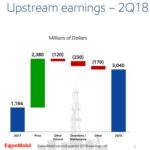

· Upstream: production down 7% y/y and 6% sequentially. Downtime driven by scheduled maintenance (Canada). Gas production was impacted by 2 reasons: seasonally weak demand in Europe, and a company shift from gas to liquids in the US (intentional shift as liquids have a higher value)

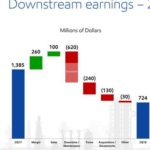

· Downstream: Earnings decreased due to scheduled maintenance, FX impact and asset sale. Exxon is preparing for the IMO 2020 impacts, leading 2019 to be another year of higher than normal maintenance activity.

· Chemical: margins were weaker on higher feed and energy costs.

A quick review of the energy sector terminology:

Thesis on Exxon (XOM)

- Strong balance sheet means the company can be opportunistic in current environment to drive future growth and profitability (acquisitions, div increase, buybacks)

- Large "Quality" business and Industry Leader = Best balance sheet and return on capital in the industry due to low production costs and high operating efficiency

- Low "beta" (less commodity sensitivity) name to reduce volatility of our overall Energy Equity exposure yet still participate in higher commodity demand/prices over time

$XOM US

[tag XOM] $XOM.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!