Current Price: $205 Price Target: $230

Position Size: 3.6% TTM Performance: 28%

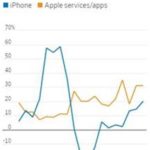

Apple beat on top and bottom line and issued guidance ahead of consensus. They missed by a very small margin on iPhone units (41m units), but this is not a key quarter for phones given new product launches in Sept. Revenues were up 17% an acceleration from last quarter and their 7th straight quarter of accelerating growth. EPS was up 40%. Growth was impressive across products with the exception of Mac and iPad. iPhone revenues were +20% almost entirely driven by price increases. Services grew 31% to $9.5B representing 18% of rev in the quarter. “Other” revenue was up 37% driven by Wearables (Apple Watch, AirPods and Beats) which were up 60%, exceeding $10B for TTM. Mac and iPad revenues were both down 5%. Together they account for about 18% of TTM revenue.

[MORE]

Thesis intact. Key takeaways:

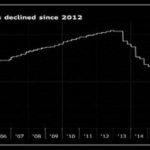

- Buybacks – they have repurchased almost $220 billion of their stock (including $20B this quarter) since they announced in March 2012 that they would start to buy back shares (and pay a dividend). Since that time, shares outstanding have dropped by about 25%.

- Price increases are sticking – iPhone X was the most popular phone in the quarter again which drove the ASP up 20% to $724. Market share leader Samsung recently reported smartphone revenue down 22% driven largely by lower ASPs, citing “intense price competition.”

- Demand is strong – substantiated not just by their ability to take price, but 3.5m units of lower channel inventory means demand was stronger than what was reported.

- Gaining share – Not surprising given the last point, iPhones grew faster than the market, taking share in many geographies including the US and Greater China. Units in the US were up double digits.

- Services performance is playing into bull thesis – Apple’s ability to monetize their >1.3B installed base through higher margin services is widely viewed as the bull thesis on the stock and next leg of growth as the smartphone market matures. (Higher margin less investment) They are on track to meet services revenue target ($50B in 2020) sooner than planned. They hit 300m paid subscribers (+60%) though they don’t break this out at all. This nice thing about this leg of growth is that it’s highly margin accretive and requires less investment in the sense that they sort of crowdsource some R&D by harnessing the power of an army of outside app developers and then share in the value they create.

- Exclusive content is a focus – This quarter they announced a partnership with Oprah for original content.

- Active installed base on iPhone grew double-digits. With units only up slightly this underscore the lengthening replacement cycle which started with the decline in subsidized phone plans.

- China – Revenues were up 19% in the quarter, slightly trailing US growth. Represents 18-19% of total sales. Top 3 selling phones in the quarter were iPhones and iPhone X was the number one phone. They opened their 50th retail store in China during the quarter.

- While Services are widely considered as the next growth opportunity, Apple also has the opportunity to grow in Enterprise. This is not really talked about much yet, but I think several things hint at their Enterprise aspirations. Tim Cook gave multiple examples on the call of how enterprises are now using iPads and iPhones (they even gave a shout out to Aramark as an example). Earlier this year they announced a new initiative that will make is easier for developers to make apps available on Macs. So apps will work across devices. With most businesses now being BYOD, having a desktop that functions seamlessly with the mobile devices that employees are already using makes sense. MSFT did this with Windows 10. It was the first version of Windows that was the same across devices. But the prevalence of Windows on desktops didn’t drive purchasing decisions on mobile. Apple may have an opportunity in the reverse. On the call Luca Maestri said “more and more companies are giving their teams a choice when it comes to the devices they use at work, including Salesforce…the majority of their 35,000 employees are using Macs.” And Cook said, “We’re working with key partners in the enterprise to change the way work gets done with iOS and Mac.” Global PC shipments last year were 262m units and Apple only has about 7% unit share. https://www.itproportal.com/features/the-rise-of-apple-in-the-enterprise/

- Trade:

- Tim Cook’s view on tariffs generally: “They show up as a tax on the consumer and wind up resulting in lower economic growth and sometimes can bring about significant risk of unintended consequences.”

- View on current tariffs: Of the three tariffs implemented so far, none of their products are directly affected. For the proposed 4th tariff of $200B that’s in comment period, they are evaluating and will give their feedback to Washington. It’s a “tedious process” and they’re not commenting publicly on that yet.

- “Cord cutting is going to accelerate and accelerate faster than widely thought.” (AAPL and GOOGL are both potential beneficiaries of this).

Valuation:

- Strong balance sheet and FCF generation continue. $129B in net cash. YTD FCF is about $48B, full yr should be about $64B.

- The stock is undervalued and the substantial buyback will support valuation. Trading at close to a 1.5% dividend yield, a 7% FCF yield and a <15x P/E.

- Returned almost $25 billion to investors during the quarter, including $20B in share repurchases. They have $90B left in their authorization.

The Thesis for Apple:

- One of the world’s strongest consumer brands and best innovators whose product demand

has proven recession resistant.

- Halo effect -> multiplication of revenue streams: AAPL products act as revenue drivers

throughout portfolio – iPhone, iPod, MacBooks, iPad > iTunes, Apps, Software, Accessories,

- Mac gaining share in PC market and iPhone robust global demand driven by China/EM.

- Strong Balance and cash flow generation.

- Increasing returns to shareholders via dividends and buybacks.

$AAPL.US

[tag AAPL]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!