TCPNX – Q 2018 Commentary

The Touchstone Impact Bond Fund performed in line with the Agg during the quarter and is slightly ahead YTD. The team continues to be conservative, remaining duration neutral and limiting its credit bets. The fund seeks to maximize yield while minimizing risks, with capital appreciation as a secondary goal.

Market Overview:

– During the second quarter, macro events created mixed investor sentiment within financial markets

o Economic data continued to be strong as job market delivered more openings than people seeking to fill them

o Corporate earnings demonstrated strong growth fueled by U.S. tax reform

– The Fed increased federal funds rate by 25 bps and signaled its commitment to keep inflation contained by moving its intended number of hikes from 3 to 4

– Despite positive economic results, market participants were concerned with potential impact of trade disputes and tight labor

o Flattening yield curve and heightening credit spreads heightened these concerns

– Demand within investment grade fixed income securities was stronger in the highest quality corners of the market

o AAA-rated securities outperformed AA-rated securities

– Despite the demand for quality, yield on U.S. Treasuries rose across the board as investor demand was unable to keep pace with increased supply

o Additional supply was the result of lower governmental revenues from tax reform

Performance Overview:

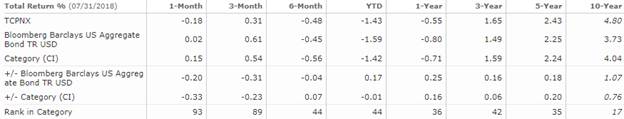

– TCPNX performed in line with its benchmark during the quarter

– Fund’s positioning in underperforming sectors was primary headwind during the period

o Overweight to investment grade bonds detracted but to a lesser degree

– Relative contributors included an overweight position to high yield corporate bonds and ABS

– Underweight to single family MBS and an overweight to Agency multi-family MBS were headwinds

– Individual position that positively contributed included Royal Caribbean Cruises, Ltd

– Detracting positions were General Electric and Union Pacific Corp.

– The fund does not make active interest rate bets so effective duration matched the bench

o While changes in the yield curve can impact total returns the fund attempts to remain curve neutral

o Throughout an investment cycle, small effects are expected to average approximately zero

Market Outlook:

– Normalization of the Fed’s balance sheet could provide a tailwind for the Fund

o Portfolio was underweight both Treasuries and Single-Family MBS

o Fed’s choice to step away from the buyers table in these sectors represents the single largest driver of demand being lost

– Thus far the pace of balance sheet moderation has been modest

o Run-rate of this normalization process is scheduled to reach $50 billion per month by the end of the year

– U.S. investment grade credit issuance is supposed to re-ignite in the second half of 2018

– If the economy were to derail, this would reduce demand for some spread sectors

o U.S. credit would most likely experience the largest negative impact

o An event causing surge in demand for U.S. Treasuries could be a concern

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!