Key Takeaways:

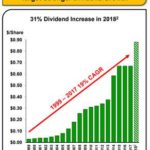

EOG reported good 2Q18 earnings and provided an update to their 2018 outlook. The full year production guidance was raised to 717.5MBoe/d – with capex unchanged – but it is now just in line with consensus. 3Q18 oil production guidance is ~1% below consensus but 4Q18 oil production implied guidance is above expectations. They still target to reduce costs by 5% this year. EOG continues to increase its dividend, pushing 2018’s increase to 31%, way above their historical average of 19%. This is a good sign that management has a positive view of the future cash flows of the company.

2H18 should see a ramp up in production and earnings thanks to:

· new discoveries: 2 new additions to its premium drilling portfolio that can earn 30% after tax return at a $40/bbl

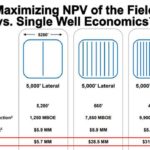

· improved efficiency in lateral drilling (see chart “maximizing NPV” below)

· Addition of 1,600 premium locations in the Powder River Basin (Rockies): this could become a key growth driver for EOG

After review of our model, we are raising EOG’s price target to $136 from $124. No change in position size (2.53%).

EOG Thesis:

- EOG is attractively valued relative to future cash flow growth and return potential

- As the leading North American Oil production company, EOG is well positioned to benefit from (1) Secular growth in US shale production and (2) Cyclical rebound in global oil production/oil prices

- We view EOG as a high quality company within a highly cyclical industry – EOG has generated 13% annual Returns on Invested Capital over the past 10 years and offers industry leading cash flow growth potential

- Though not immune, EOG’s stock protects better than most energy stocks on the downside due to its high quality nature – strong balance sheet, ROIC, & cash flow generation

- As such, we view EOG as offering the potential for superior risk-adjusted returns over a market/commodity cycle

$EOG.US

[tag EOG] [tag

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!