Current Price: $39.50 Price Target: $43

Position Size: 2% TTM Performance: <1%

· Aramark reported 3Q18 earnings, beating on the top and bottom line, maintaining full year EPS guidance of $2.20-$2.30.

· Revenue was up 9% constant currency with about 4% organic growth. That organic growth was a nice acceleration from 2% last quarter.

· Raised organic revenue growth guidance from 3% to 3.5%.

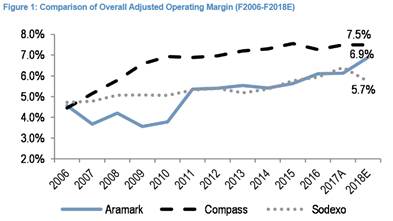

· This report was a big relief (sending the stock up over 8%) because they are finally delivering solid organic growth and look to hit the adj. margin targets they’ve been promising. This was especially important because heading into the quarter guidance was heavily back-half weighted. They should hit their full yr margin target of 7.2% that was set in their analyst day in 2015. Given first half results, investors were skeptical of their ability to achieve this.

· A couple of announcements on the innovation front:

o On the food service side, they announced a strategic partnership with a local company, Oath Pizza (started on Nantucket).

o On the uniform side, they announced this quarter the launch of a new “athleisure” premium performance uniform line called FlexFit.

· Retention rate remains strong in mid-90’s.

· Adj. operating margins expanded 60bps on productivity improvements and lower overhead. Top line growth combined with margin expansion led to op. income up an impressive 20% on a constant currency basis. The adjustments however are a little questionable and a good reason to look at this stock on a cash flow basis. Essentially, they capitalize some important revenue generating expenses that they are trying to get you to altogether exclude by adding back their depreciation to arrive at adj op income.

· They are closing the margin gap with industry leader, Compass Group and have now strung together two consecutive quarters of improvement in adjusted operating margins in conjunction with top line growth. The two together had been elusive for a while. In 2017, they disappointed with organic growth, but saw margin expansion. Then in Q1 they saw meaningfully improved top line growth at the expense of 50bps in margin contraction.

· Longer term, their acquisitions will help with margins through increased purchasing scale with Avendra and better capacity utilization and route density with AmeriPride.

· Inflation: they saw an uptick in labor inflation but feel comfortable with their ability to deal with this based on pricing power as well as investment to improve productivity. E.g. investing in consumer-facing technologies, self-help kiosks

Valuation:

· On a P/E basis they trade at a discount to peers, history, and the S&P 500.

· On a FCF basis they trade at about a 4% forward FCF yield.

· Balance sheet is pretty decently levered but should improve. With recent acquisitions, leverage ratcheted up, but they target 4.5x by year end and 3.5x by 2020.

Thesis:

· ARMK is an industry leader in the food, facilities, and uniform outsourcing market. The market is large and growing supported by favorable outsourcing trends.

· Aramark has an opportunity to continue expanding margins driven by productivity initiatives and operating leverage. The stock currently trades at a trough multiple vs. the market and at

a discount to peers which I expect to mean revert thanks to low double digit EPS growth for the next few years driven by margin improvement, deleveraging, and improving top line.

· ARMK is well positioned to weather economic cycles due to a diversified customer base and greater than half of their revenues coming from non-cyclical industries. As deleveraging continues shareholder returns should increase via dividend growth and buybacks.

$ARMK.US

[tag ARMK]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!