As you probably know Turkey’s currency, the Lira, has fallen over 70% in value relative to the US Dollar over the past year. The currency declined steadily over the past year and the pace accelerated this month as there has been a rush to get capital out of Turkey.

How did Turkey get here?

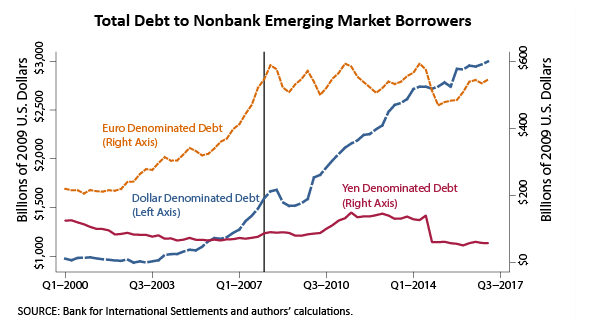

A main part of Turkey’s vulnerability is due to rapid growth in US dollar borrowing. Years of near-zero interest rates in US has spurred lending in Dollars overseas. Below is a chart from St. Louis Fed that shows since 2003, lending in Dollars to non-bank emerging market companies has grown from $1 trillion to $3 trillion in 2017 (blue line).

Companies borrowed in Dollars, because at the time funding was cheap and plentiful. Emerging market debt funds were eager to buy EM corporate bonds which comprised a majority of the loan growth. US investors were happy for higher interest rates and borrowers enjoyed the inexpensive financing. Both parties underestimated or ignored the risk of having Dollar exposure. Problem with these loans is that the company earns money in their local currency to pay interest and principal on the loans in Dollars. As the local currency falls against the Dollar, the interest payment increases. In Turkey, interest payments (unhedged) have increased 70% YTD due to the fall in the Lira. Yikes!

Turkey has other vulnerabilities – trade deficit, high inflation and budget deficit. The twin deficits mean that Turkey relies heavily on foreign capital to function, while inflation erodes the value currency. However, it seems the main issue is Dollar debt and the drop in the value of the Lira.

How serious is this for Turkey’s economy?

This plunge in Turkey’s currency is very serious. Turkey will most likely face a recession as the sudden and steep drop in currency will lead to a slowdown in growth. Their highly levered banking sector (loan to deposit ratio of 145% versus US banking system’s ratio of 70%) will need capital to continue making loans to support economic growth. Turkey runs a current account deficit, so trade is not a source of external currencies, but a drain. The steep drop in the value of the Lira shows that market confidence in Turkey is gone. Further lack of confidence in the regime of Recep Erdogan, a dictator with a history of human rights abuse, will be a huge hurtle in obtaining loans from developed countries. Without support it is likely that Turkey faces a severe recession, defaults and a tough decade. The outlook is not good – think Venezuela.

Will Turkey’s problems spread?

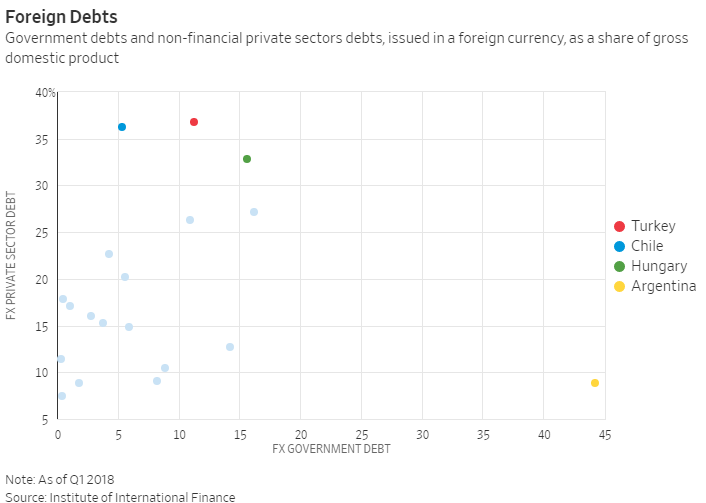

Probably. Higher interest rates and stronger US Dollar are a strong headwind for emerging markets especially where there has been heavy Dollar borrowing. In June, Argentina received a $50b bailout from the IMF to help maintain their currency value, so Turkey’s difficulties were not first. Chile, Hungary, Egypt, Brazil and Argentina all have sizable borrowings in foreign currencies. Some of these countries, Argentina, Brazil and Turkey, run trade deficits which can also pressure currency valuations.

Turkey is not alone in the economic characteristics that precipitated this collapse of confidence, but it is not a given that the fear will spread. Certainly markets will keep a watchful eye on similar markets. Please see WSJ article: https://www.wsj.com/articles/turkeys-economic-red-flags-stand-out-among-emerging-markets-1534336200?mod=searchresults&page=1&pos=7

What about Crestwood’s clients?

Crestwood has avoided EM debt funds despite very tempting yields. We believe that bond investors do not get properly paid for currency risk. Also, froth in the EM dollar lending boom was clear. Recall the 100 year Argentinian bond issue? $2.75 billion sold last June despite Argentina’s history of defaulting seven times on external debt. They made it 12 months before needing an IMF bailout. Currently, the bonds are selling $89 on $100 par – only 99 years to go! Or the $500b Tajikistan bond issue to finish a massive dam started by the Soviets in 1970’s. The par value of the bonds represents 15% of countries annual GDP and raises Tajikistan’s external debt level to 50% of GDP. Those too are selling at $89 per bond.

As we have mentioned, we believe the role of bonds in the Growth model is to provide diversification to the equity holdings which provide 90% of the risk. EM Debt does not provide much diversification especially in risk-off periods.

In Crestwood’s Growth model, our exposure to emerging market stocks is modest, standing at 4%. We continue to be overweight US equities (75% of equities) versus international equities (25% of equities).

Please let me know if you have any questions or comments.

Thanks,

John

John R. Ingram CFA

Managing Director

Asset Allocation and Research

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109