Current Price: $46 Target Price: $54

Position size: 4.4% TTM Performance: 47%

Thesis intact, key takeaways:

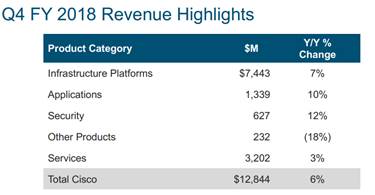

· Cisco reported a really solid Q4 with better than expected sales and EPS and issued well above consensus FY19 sales growth guidance of +5-7%.

· They continue to make progress on their transformation from a hardware business to a software and services focused business. The percentage of recurring revenue is now at 32% – they set a goal of 37% by 2020.

· Campus switching strength – Infrastructure Platforms segment (58% of revenue; +7% YoY) driven solid demand for their Catalyst 9k products. Catalyst 9K was launched last year, best ramping product in the company’s history and only sold with a subscription. It’s a key part of their strategy of shifting to recurring revenue.

· Positive inflection in Service provider demand. Service provider orders (+6% YoY) grew for the first time in over 2 yrs driven by a large carrier footprint build-out in Asia as well as better trends in US cable. Management, however, continues to be cautious in forecasting this segment given the lumpy nature of the service provider business.

· Similar to last quarter, gross margins were a disappointment. Last quarter gross margin compression was driven almost entirely by higher memory costs. This quarter memory cost issues persist and also higher growth in Asia came at the expense of lower margins. Mix shift towards servers was also a drag. Margins should move higher over time driven by higher subscription software sales.

· Cisco is another company well positioned to benefit from the increasing adoption of hybrid cloud (along w/ MSFT): Their customers are undergoing a fundamental shift in their technology infrastructure. Historically, large enterprises have run applications in their private data centers. Now they still have applications running in private data centers, but also are consuming SaaS applications and services from public cloud providers. This is essentially what hybrid cloud is. A mix of on-premise and off-premise. Large companies with large expensive data centers, sensitive data, and lots of sunk technology costs are taking a slower, staged approach to moving to the cloud. With it their networks and how their traffic is flowing and how it is secured has fundamentally changed – data is destined for 50 locations instead of just a private data center. Networks are proliferating and the coming internet of things (IoT) and 5G will drive even more proliferation. So, companies are having to rethink their entire IT infrastructure and Cisco is at the center of this transition, which is leading to the success they are seeing.

· Recently announced Duo Security acquisition is an example of how they are helping customers navigate a hybrid cloud world. Duo has SaaS-delivered authentication and access solutions that will expand Cisco’s cloud security capabilities to help enable any user on any device securely connect to any application on any network.

· “Other products” (~2% of revenue; -18% YoY) continues to be a slight drag on growth. They plan to divest a portion of this – Service Provider Video.

· Returned $23.6B to shareholders over the full year, representing 184% of FCF (>FCF b/c of repatriation). That was made up of $17.7B of share repurchases and $6B dividend.

Valuation:

· They have close to 3% dividend yield which is easily covered by their FCF.

· FCF yield of over 6.5% is well above sector average and is supported by an increasingly stable recurring revenue business model and rising FCF margins.

· The company trades on hardware multiple, but the multiple should expand as they keep evolving to a software, recurring revenue model. Hardware trades on a lower multiple because it is lower margin, more cyclical and more capital intensive.

Thesis on Cisco

· Industry leader in strong secular growth markets: video usage, virtualization and internet traffic.

· Significant net cash position and strong cash generation provide substantial resources for CSCO to develop and/or acquire new technology in high-growth markets and also return capital to shareholders.

· Cisco has taken significant steps to restructure the business which has helped reaccelerate growth and stabilize margins.

$CSCO.US

[tag CSCO]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!