HILIX – Q2 2018 Commentary

The Hartford International Value Fund underperformed its benchmark during the quarter but has returned slightly higher over the past year. The team continues to invest in companies with low relative price and low broad market expectations that feature strong balance sheets and significant upside potential. The strategy’s deep value focus has been a relative headwind as value has underperformed growth during the year.

Market Overview:

– International equities posted negative returns over the quarter ending the first half of the year down

– Escalating trade tensions were a drag on sentiment

o The U.S. threatened tariffs on European autos in response to the EU’s retaliatory tariffs on American products

– U.S. also imposed additional levies on Chinese goods and China vowed retaliatory tariffs

– While the Fed has indicated a potential for two additional hikes this year, the ECB and Bank of China had a more dovish undertone

o This led to a stronger dollar and weaker performance for non-U.S. markets in general

Performance Overview:

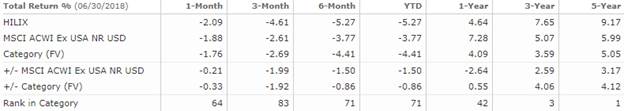

– The Hartford International Value Fund underperformed its benchmark during the period

– Underperformance was driven primarily by stock selection across multiple sectors

o This includes industrials, energy, materials, utilities, and financials

– Sector allocation contributed to relative performance during the period driven by our overweight to energy and underweight to financials

– Stocks in EM contributed positively to relative results while our Japanese holdings underperformed

– From a style perspective, value significantly underperformed which was a headwind for the strategy

– Among the top relative detractors during the period were JSR Corp. and Metro AG

o JSR is a Japan-based chemical materials manufacturer

o Metro AG is a wholesale/cash and carry company based in Germany with locations in various countries including Russia

– Top relative contributors during the period were Sainsbury and BP

o Sainsbury is a UK-based retailer, and financial services provider with a network of supermarkets

o BP is a UK-based integrated oil company

Market Outlook:

– They used share price strength within the energy to reposition within the sector

o Eliminated position in Equinor

o Trimmed integrated holdings in BP, ENI, and Total

– Initiated a position in Air France-KLM, one of three major European airline companies

o The company recently underperformed due to labor strikes

o Had previously owned Air France and sold less than a year ago

– Eliminated the several positions from the Fund during the quarter

– The team continued to focus on opportunities in companies with low relative price, low expectations, and low valuations that feature strong balance sheets and significant upside

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!