Key Takeaways:

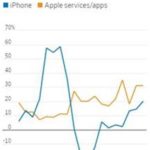

· Resmed is winning shares in the US: devices +9%, masks +12% (better than last quarter, and removing our fear of share loss to competitor Philips)

· Rest of the world devices sales +6% slower than last quarter as fleet upgrade slows down (big boost last Q in France & Japan not repeated this Q). Rest of the world masks sales still impressive at +16% (upgrade in masks)

· Acquisition of HEALTHCAREfirst (software of home health/hospices) during the quarter will add growth to Brightree (sales +12% this Q). Terms of the deal not disclosed. We like Resmed push into Saas (software-as-a-service), as a way to increase recurring revenue and diversify from the cyclicality of devices/masks sales due to introduction of new models

· Margins in line with their guidance at 58.1%, but below consensus: lower prices were offset by better manufacturing & procurement efficiencies. We like the recent trend of gross margin stability, which combined with lower SG&A expenses as a % of sales (thanks to scale benefits and cost reductions), will help boosts RMD’s operating margins

· FY19 guidance introduced:

ü Gross margin consistent with 4Q18 of ~58%

ü SG&A 24-25% of sales – lower than FY18 and the lowest of its history

ü R&D 6-7% of sales (a good rate to maintain top line growth)

ü Tax rate 22-24%

While we still like Resmed’s company profile and growth trajectory, the shares appear fully valued today. Our updated price target is $109, assuming continued double digits growth in the next 4 years and FCF margin stability. Current position size: 2.56%, current price: $108.6.

Continue reading “Resmed (RMD) 4Q18 earnings recap”