This week, UNP announced their intention to implement the Precision Scheduled Railroading (PSR) strategy, starting October 1st. The stock reacted positively on the news, however we have some reservations that this strategy will drastically change UNP like it did for other rail companies in the past (CSX being the latest example).

So first, let’s go over what “Precision Scheduled Railroading” is:

This system includes focusing on moving rail cars instead of trains (car velocity), mixing types of freight, and keeping a balanced flow of train movements. The approach, which involves running shipments on fixed timetables to ensure reliable deliveries, was a novelty in the North American industry at the time it was developed by Hunter Harrison. There is a strong focus on asset utilization, with rightsizing the employee count (usually followed by a 20-25% cut the first year), rail yards diminution, sale of real estate and locomotive fleet count.

Who was Hunter Harrison (deceased in December 2017)?

Served as CEO of Illinois Central Railroad, Canadian National Railway, Canadian Pacific Railway and CSX Corp.

He gained fame for developing the precision railroading strategy, breaking with the standard industry practice of holding trains until they were full. He aggressively cut costs and ran a more efficient rail system.

While he temporarily retired between his role of Canadian Pacific CEO and CSX CEO job (another good story to read: https://www.institutionalinvestor.com/article/b1505q2v83gm50/mantle-ridge-up-to-nearly-$2-billion-on-csx-play ), he bred show jumping horses.

How is UNP’s Unified Plan different from Harrison’s PSR?

UNP will not close or convert any of its switch yards. With PSR, the company converts hump yards into flat facilities within 1 year.

UNP has no management team member with prior PSR experience.

UNP’s approach does not focus on operational gains at the expense of customer satisfaction (in traditional PSR, changes are made quickly, creating disruption in service at the expense of client’s satisfaction)

UNP’s approach is less aggressive in employee reduction plans

UNP plans will be done in stages, vs. Harrison right away whole implementation

My expectations is that the operating ratio will not improve beyond the current target of 60% by 2020 (announced before the PSR implementation was announced), but will just help UNP get there. We might see some hiccups along the way as they push this new strategy to their clients and employees.

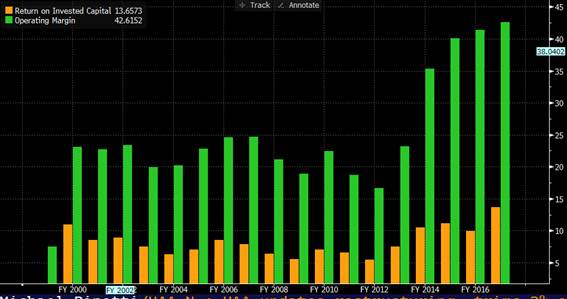

For reference, below are Harrison’s former companies ROIC and operating margins improvements under his leadership, showing that the PSR works:

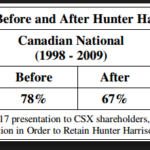

Impact of Harrison’s on CSX (2Q17-4Q17):

Impact of Harrison on Canadian Pacific Railway (4Q09-1Q17):

Impact of Harrison on Canadian National Railway (1Q2003-4Q2009)

[tag UNP]

$UNP.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109