Key Takeaways:

Current Price: $136 Price Target: $163

Position size: 2.67% 1-Year Performance: -1.6%

JNJ reported 3Q18 earnings results that beat consensus thanks to strong Pharma sales again (+8.2% organic). In Pharma, the growth of Stelara, Zytiga, Imbruvica and Tremfya help offset Remicade’s decline due to the generics competition. It is reassuring to see that JNJ’s portfolio of drugs is vast enough to offset the erosion of Remicade. JNJ doesn’t expect a big change in drug pricing in its portfolio in 2019, seeing continued pricing pressure in categories with high competition (diabetes, immunology…). Medical Devices grew an anemic +1.7% organic, similar to last quarter and for the same reasons (weakness in diabetes –pump discontinuation- and Ortho –share decline & pricing pressure). The company expects some innovation to help turn the business in the right direction, and is open to small tuck-in M&A and/or a bigger asset purchase. Their Consumer segment is finally showing positive growth +4.9% thanks to the relaunch of the baby care, women’s health performance, oral care rebound, Beauty and OTC drugs. Guidance for organic sales growth in 2018 was raised by 50-100bps, and operational revenue to $81-81.4B (from $80.5-81.3B), and EPS guidance was lifted by 4 cents.

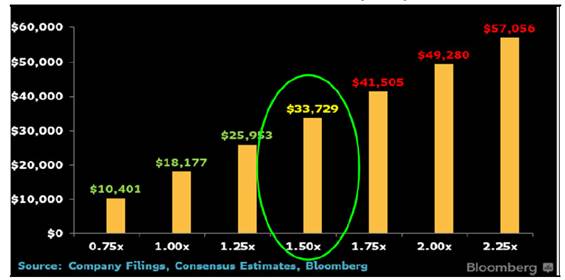

We think the poor Medical Devices performance needs to be addressed very soon by the management team with either divestitures of poor performing sub-segments and/or acquisitions of higher growth brands (as mentioned during the 2Q18 call). Bloomberg’s analysis shows the potential for $30B in deal capacity next year, following recent divestitures of assets.

Valuation: no change

- Stock is supported by a ~5.7% FCF yield and a 2.65% dividend yield

Thesis on JNJ reiterated:

- High quality company with consistent 20% ROE, 4+% FCF yield,

- Investments in the pipeline and moderating patent expirations create a profile for accelerated revenue and earnings growth

- Growth opportunity: Medical Devices and Consumer offer sustainable growth and potential for expansion internationally

- Strong balance sheet that offers opportunities for M&A.

[tag JNJ]

$JNJ.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109