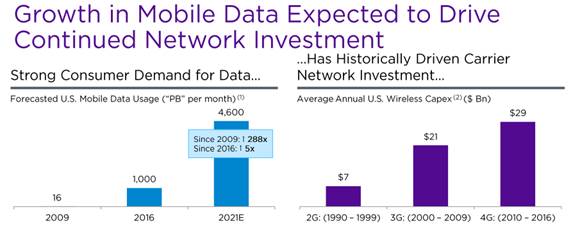

Crown Castle International Corp. (CCI) had another strong quarter, outpacing guidance and expectations for revenue and AFFO per share. CCI introduced slightly higher guidance for revenues and adjusted EBITDA for the remainder of the calendar year. The company increased its annual dividend to $4.50, a 7% increase YoY. Growth in the towers space continues to be driven by consumer demand for data which leads to investment by mobile carriers. Within the space, CCI is best positioned to take care of carrier needs across towers and small cell/fiber. CCI’s investment in small cells and fiber are performing better than expected and the company’s margins should continue to improve as they increase colocation on their newly developed small cells.

Current Price: $107 TTM Return: 11.1%

Target Price: $125 Position Size: 2%

Thesis intact, highlights on the quarter:

Rental revenue continues to grow:

- Q1 total site rental revenue up 33%

- Approximately $52 million in organic contribution plus $219 million in contributions from acquisitions and other items

- Organic contribution to site rental revenue represents approximately 5.8% growth

- Approximately 8.4% growth from new leasing activity net of 2.6% from tenant non-renewals

- New leasing activity is accelerating. Lease-up on small cells about 2x the rate they experienced on towers.

- Churn remains low at 1-2%.

Consumer demand for data drives investment spending by carrier networks:

- Big 4 carriers make up 90% of site rental revenue – AT&T, Sprint, T-Mobile and Verizon. Corporate tax reform may prompt them to increase infrastructure investments.

- CCI small cell pipeline is now at a record 35,000 nodes, a 40% increase over last year

- There is a potential risk in lost revenue if T-Mobile and Sprint were to merge

- Exposure to T-Mobile and Sprint accounts for 19% and 14% of overall revenue respectively

- Overlapping tenancy between two carries accounts for about 5% of revenue with average of 5-7 years left on the contracts

- It is possible that a merger could lead to immediate investment by Verizon and AT&T in order to keep pace with any synergies established by the merger

Expect investments in small cell and fiber to ultimately yield mid-to-high teens returns

- CCI continues to deploy capital toward fiber investments; first tenant yields 5-6% while a second tenant will yield 10-12%

- Fiber opportunities providing long term opportunity for high growth

- Closed three acquisitions in 2017: FiberNet, Wilcon and Lightower, expanding their high capacity metro fiber assets

- Assets have capacity to support organic growth and high incremental margins.

- Return assumptions on these fiber asset acquisitions based on current applications, i.e. new technologies like 5G, IoT, augmented and virtual reality would be upside

- These technologies all would rely on CCI infrastructure assets for higher speed and lower latency requirements.

- Attractive shared economic model in small cell business. Lowest cost and fastest time to market for their customers.

- Multiple ways to monetize fiber assets improves returns and lowers cost and value proposition to customers.

Valuation:

- Strong AFFO growth will drive the valuation (up 26% yoy). They have a 10 year AFFO CAGR of 14%.

- High incremental margins means AFFO growth should outpace site rental revenue growth.

- Low maintenance capex (~2% of revenue) supports high AFFO margins.

- $2.2B in AFFO ($5.50/share) in 2018 is a yield of 5%. This is an attractive yield given the secular growth potential.

The Thesis on Crown Castle:

1. CCI is well positioned to capitalize on secular mobile data demand growth and small cell/urban opportunity.

2. Strong competitive position. Leading US tower company.

3. Toll booth business – offensive (secular growth) & defensive (4% dividend & contracted cash flows) characteristics.

4. Revenues derived from long term contracts with price escalators and good visibility.

$CCI.US

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109